We’re reader-supported. When you buy through links on our site, we may earn an affiliate commission.

The best banks for small businesses meet a wide variety of needs and offer support as your business grows. According to a U.S. Bank study, 82% of businesses that fail claimed cash flow problems as a contribution to their failure. That’s why trusting the right bank with your hard-earned money is so important.

To make an informed decision, you’ll want to know your account options, business loan terms, and what sort of fees you’ll pay for a business bank account.

Also, your business might be classified as high-risk for a number of reasons – sometimes it's just the industry you're in. That's why in some cases, high-risk credit card processing might be a factor to consider. This means the bank is willing to deal with a business deemed as “high risk” for any reason. Card payments always involve some kind of risk, but in the case of high-risk transactions (HRTs), the odds for issues such as chargebacks are higher.

We’ve done our research and selected three of the best banks for small business, so you don’t have to. Let’s explore your options.

Table of Contents

What is the Best Bank for Small Business?

- Chase Bank – Absolute Best Overall

- Axos Bank – Best Value

- NBKC Bank – Best Free Starter Option

1 – Chase Bank – Absolute Best Overall

We rate Chase as the best bank for small business overall because of the convenience, flexibility, and support it offers business owners. Join over 4 million businesses that bank with Chase and experience all of the awesome benefits firsthand. Chase is available in 48 states, with more than 4,700 branches and 16,000 ATMs to choose from.

Chase for Business offers up to three business checking accounts and two business savings accounts. Both accounts are designed to complement one another. You can do all of your banking in one place thanks to Chase’s convenient, easy-to-use online portal and mobile app, where you’ll get a full picture of your business's financial status. Chase business savings accounts allow you to earn interest so you can build your wealth over time and plan for the future.

Pro tip: Get out of paying the $15 monthly fee by maintaining a minimum balance of $25,000.

Chase doesn’t only offer checking and savings accounts. The Chase Ink Business credit card is one of the best business credit cards because it offers payment flexibility where business owners have the option to pay off eligible purchases over time when they need to. Employee cards are also available free of charge.

Even when your numbers are looking great, extra support and information never hurt. That’s why Chase for Business offers access to their customer support team and multiple consulting services to guide you through the complex world of finance. Their services are designed to help you run your business smoothly.

Top 5 Benefits of Chase Business Banking

1 – Get Paid Easily with no hidden charges through QuickAccept – Simply activate QuickAccept with a Chase Business Complete Banking account to begin accepting credit card payments at any time from anywhere in the US.

2 – Enjoy Peace of Mind Thanks to Fraud Protection – Chase provides 24/7 fraud monitoring which will take notice of any unusual account activity.

3 – Invest Extra Money into Your Business by Earning Cash Back on Purchases – You have the option of earning up to 1.5% cash back on all of your business purchases with the Ink Unlimited credit card and 5% cash back from the Ink Cash credit card. We can all use some extra savings to use for the growth of our businesses.

4 – Boost Your Business Skills with Curated Entrepreneurial Coaching – Chase offers a free program called Curated Coaching for Entrepreneurs, where business owners have the opportunity to receive small-group business mentorship and learn the skills they need to grow their businesses.

5 – Grow Your Business with Help From Chase’s Flexible Financed Loans – Whether you want to acquire another franchise or upgrade your technology, as a business owner, sometimes you’ll need a helping hand. Chase knows this and has several borrowing options to choose from.

There are several ways to waive the $15 monthly fee with the business checking account, like maintaining a minimum daily balance of $2000. QuickAccept is a built-in payment solution that comes with the Chase for Business checking account. It allows you to make same-day deposits and free up the cash you need to deal with your business expenses. QuickAccept costs 10 cents plus 2.6% for tap, swipe, and dip transactions and 10 cents plus 3.5% for manual transactions.

In addition to all of the practical benefits we covered, for a limited time, Chase for Business offers a $300 bonus for new clients. All you need to do to collect it is open an account, deposit a total of $2000 and maintain this minimum balance for at least 30 days. Finally, you’ll need to complete five qualifying transactions within the first 90 days of opening your account.

Looking for more ways to earn money and share your favorite apps? Check out my guide to referral bonus apps.

Zach & Zoë, a family-owned bee-keeping company, say they love the way Chase values relationships. Kam, the co-founder, and co-owner, says:

“I’m going to be really candid. You may think all big banks are the same. They’re just not. I’m 41 years old, and I’m kicking myself for not, frankly, going with Chase earlier, because it is night and day.”

Check out this video covering their experience:

| Pros | Cons |

| Easy credit and debit card processing is available with QuickAccept | Low-interest rates for business savings accounts. The regular savings account earns you 0.01%, while the Premier savings account earns you 0.02% |

| Fraud protection keeps your business assets safe. | The Platinum Business Checking account costs about $15 per month |

| Earn cash back with Chase Ink credit cards | $34 overdraft fee for each transaction, beginning with the first transaction that overdrafts your balance by 50$ or more |

| Learn new business skills with Curated Coaching for Entrepreneurs | |

| Take out hassle-free loans with flexible payment options | |

| $300 welcome bonus (conditions apply) | |

| Conveniently located at 4,700 physical branches with 16,000 ATMs available | |

| User-friendly online portal and mobile app allow you to bank from anywhere at any time |

If you want to benefit from all of the amazing benefits Chase has to offer, open an account with them here.

2 – Axos Bank – Best Value

The best bank for small business will know that most of the action happens online. Though Axos doesn’t have a physical branch where you can do your banking, it offers everything a business owner would need- all online.

Axos has made ease of use a priority with its Quickbooks integration and additional mobile tools, which allow you to manage your account from anywhere at any time. In addition, there’s no need to worry about glitchy or clunky mobile services, as the Axos mobile app has received excellent reviews from both iOS and Android users.

There is no minimum balance requirement with Axos, which is a relief for many business owners who want to avoid fees – especially new ones. In addition, the basic business checking account has no monthly fee at all!

Axos makes it easy to manage finances as a team by adding others to your account. In addition, you can adjust the settings to control who can do what in order to avoid confusion. If you end up running into any problems, you can contact Axos’ 24/7 customer service for help. According to client reviews, they’re quick to respond and effective.

In addition to great ratings from clients, Axos has received glowing reviews from Nerdwallet, Forbes Advisor, and Well Kept Wallet. Let’s explore some of the benefits you’ll enjoy as an Axos client.

Top 5 Benefits of Axos Business Banking

1 – Save Money by Opening a Basic Business Checking Account with No Monthly Fee – No need to worry about waiving a monthly fee here!

2 – Save Yourself the Trouble of Going to the Bank – Axos provides you with all of the online tools you need to manage your finances, which means there’s no need to leave your house to wait in line at a bank.

3 – Get Paid Easily with a Wide Variety of Payment Processing Tools – Axos allows you to accept checks, eCommerce payments, and unlimited debit and credit processing. Convenient for you and your customers!

4 – Get the Support You Need with 24/7 Customer Support – Live 24/7 support can answer any questions you may have. It’s available over the phone and a virtual assistant named Evo (that’s an unusual name).

5 – Make Informed Financial Decisions with Customized Reporting – As a business owner, you know that there are tons of decisions that need to be made on a daily basis. To help you make informed decisions, Axos provides you with a comprehensive dashboard to keep you up to date on the status of your business bank account.

Axos is an awesome choice for anyone on a budget (all of us). There is no monthly maintenance fee, so you can focus on investing in your business.

Leslie, a small business owner in Washington D.C., appreciates Axos for its customer support. She specifically appreciates having a personal account rep who knows her on a personal level and understands the unique needs of her business. She says:

“Just because this is an online bank doesn't mean that one doesn't get personal service like at a neighborhood bank. I do not have to call an 800 number and spend endless time waiting to speak to a random person who does not know my account. Having a personal account rep at Axos is probably the best part of the banking experience. When I opened my second business account, I did not hesitate to go back to Axos.”

If you’re interested in the most affordable account option from one of the best banks for small businesses, check out this video from Axos Bank to learn the basics:

| Pros | Cons |

| No monthly fee for the basic business checking account | No in-person appointments |

| Completely Online | |

| Many payment processing options are available | |

| Enjoy 24/7 customer support | |

| Customized reporting | |

| $200 welcome bonus available (conditions apply) | |

| The Quickbooks integration will help you keep your finances organized | |

| The mobile app makes banking simple and convenient | |

| Add team members to your account to streamline your workflow. |

Axos is one of the best places to start your business bank account. Convenient, affordable, and supportive, Axos is the perfect home for the modern business bank account. Get started here.

3 – NBKC Bank – Best Free Starter Option

NBKC is the best bank for small businesses seeking to stay within a budget. Money management is a worthy investment, but oftentimes, it gets expensive to keep up with the additional fees that banks charge for beneficial business services.

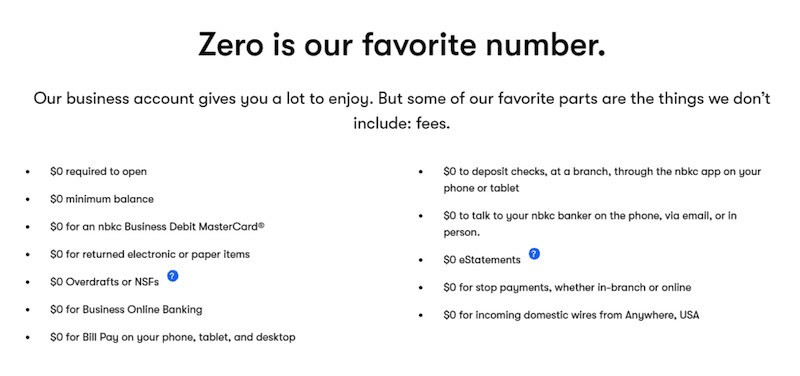

NBKC doesn’t require you to start with a minimum balance requirement, no monthly maintenance fees, no required opening deposit, and unlimited transactions. It’s great for any business owner, but new entrepreneurs, in particular, will appreciate NBKC’s straightforward features.

NBKC makes it easy for their customers, which has earned them a 4.5 out of 5-star rating.

Top 5 Benefits of NBKC Bank

1 – Save money with free checking and savings accounts – NBKC states on their website that zero is their favorite number. If you’re only looking for basic services like a checking account and savings account, you won’t have to pay a cent in monthly maintenance fees.

2 – Meet your business’ unique needs with customizable ad-ons – NBKC offers a variety of business solutions designed to streamline your workflow. You can customize your add-ons based on what your business needs.

3 – Get the helping hand you need in minutes with flexible loans – If you qualify, you can apply for a loan to cover almost any business expense in minutes and receive your funds within a week. There are a variety of financing options available depending on the financial situation of your business.

4 – Never worry, thanks to fast, secure transactions – When transactions occur online, many people worry about the security of their transactions. All funds are managed online but processed in-house to ensure the security of your funds and make sure no suspicious activity escapes NBKC’s attention.

5 – Bank conveniently with full online capabilities – While most banks offer mobile and online banking options, some activities still require business owners to visit their local branch to complete certain transactions. NBKC allows you to complete all transactions online – including applying for a loan.

NBKC has all the (free) basics a small business would need, such as unlimited transactions, ATM access, and mobile banking. Plus, there are several add-ons available at low monthly rates.

You can integrate Autobooks, an invoicing software that not only allows you to send invoices, accept payments, and track payment activity for only $10 per month. In addition to Autobooks, you can get desktop deposit features and an extended archive for $15 per month. Business fraud protection will cost an extra $5 per month.

NBKC also offers the Business Money Market savings account. It is a free high-interest savings account. It will allow you to start earning interest over time without needing a large initial investment.

NBKC clients Mic and Missy Johnson say in their testimonial that they are not NBKC’s biggest clients, but it never feels like that. They get the impression that NBKC really cares about their customers. “If I have something that I need NBKC to do, they get it done quickly so I can check it off my list and can get back to other things that have to do with our business.”

Check out the awesome benefits of NKBC Business Checking in this video:

| Pros | Cons |

| Save money with free accounts | No branches outside of Kansas and Missouri |

| Enjoy a wide range of customizable add-ons | Add-on fees |

| Flexible loan options | |

| Secure transactions | |

| Full online capability lets you do it all from home | |

| Unlimited transactions |

NBKC is one of the best banks for small businesses. It’s affordable and customizable, making it an excellent choice for entrepreneurs new, and old. If you’re interested in trying it, check out the details here.

Common Questions About Banks for Small Business

Which Type of Bank is Best Suited for Small Business?

Chase Bank is the absolute best bank for small businesses. It combines convenience and cost-effectiveness with expert entrepreneurial training – a valuable tool for any businessperson looking to develop their skills and bank with the best.

How Do I Choose a Bank Account for My Small Business?

When choosing a bank for your business, you’ll need to determine what your financial needs are, determine the scale of your business, evaluate your credit, and identify your goals to make an informed decision. Still struggling to decide? You can’t go wrong with my best value option, Axos Bank.

Which Bank is Best for the Self-Employed?

We think NBKC Bank is best for the self-employed. It allows business owners to manage their accounts from their devices and maintain their independence and save valuable business time. In addition, in-person help is also available when it’s needed.

How Much Money Do I Need to Open A Business Bank Account?

This depends on what account you choose to open. Most basic business bank accounts will have a $0.01 minimum deposit requirement which allows you to get started even with little available funds. Accounts that offer more premium services tend to have higher minimum deposit requirements.

Who Needs a Business Checking Account?

Anyone running a business of any kind would benefit from having a business checking account. When your company becomes an LLC (check out ZenBusiness and my LLC checklist if you need help getting this set up), it’s advisable that you separate your personal finances from your business finances. Learn Why do you need an LLC to protect your business. Here's an LLC 101 starter guide. And get help choosing the best LLC service with this Bizee vs ZenBusiness comparison.

What Banks Have Free Business Checking Accounts?

All three of these: Chase, Axos, and NBKC, have plenty of business checking accounts available.

Best Banks for Small Business LLC?

Chase Bank is the best bank for small business LLCs because of the extensive support it offers business owners and the institution’s centuries-long history of serving businesses.

Post-Game Report: Best Banks for Small Business Champions

- Chase Bank – Absolute Best Overall

- Axos Bank – Best Value

- NBKC Bank – Best Free Starter Option

Related: