We’re reader-supported. When you buy through links on our site, we may earn an affiliate commission.

Bookkeeping can be dreadful. Luckily for small business owners, there are software solutions designed to off-load the tedium of this necessary evil.

According to a study published in Advances in Science, Technology and Engineering Systems Journal, “accounting software has increased annual business profits by 15%. It also reduced labor costs by 50%.” If you’re still not convinced that it’s time to try accounting software, keep reading. I’ve compiled a list of the five best small business accounting software programs that will save you so much time you’ll never look back.

Table of Contents

What is the Best Small Business Accounting Software?

- Intuit QuickBooks – Absolute Best Overall

- FreshBooks – Best Value

- Wave Accounting – Best Free Starter Option

Best of the Rest

1 – Intuit QuickBooks

With 5.6 million users worldwide, QuickBooks is one of the most popular accounting software programs for small business owners. Many accounting experts consider it the industry standard. It’s flexible and scalable making it perfect for any small business seeking to grow.

QuickBooks allows you to handle all of your business finances in one place. You can create invoices, accept payments, pay your business expenses, track time, and keep tabs on your performance with detailed reports.

Thorough, user-friendly, and customizable, Quickbooks can help you save tons of time and money. On average, small business owners using QuickBooks find 4,200 in annual tax savings. Think of all the ways you could use those extra funds to build your business!

Top 5 Benefits of Intuit QuickBooks

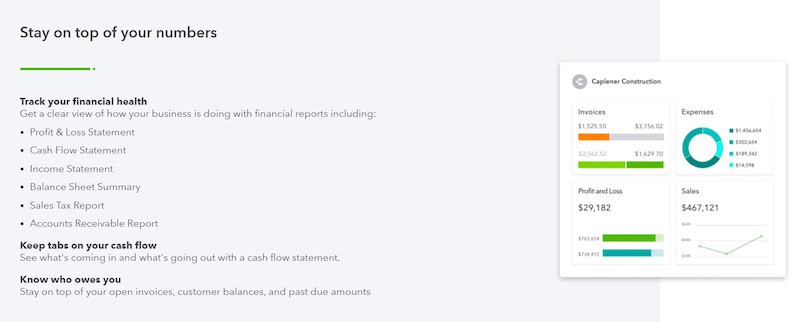

1 – Make Informed Business Decisions – Your income isn’t the only important figure small business owners should keep track of. Following the principles of double-entry accounting, QuickBooks gives you comprehensive reports on several aspects of your small business cash flow. This includes a profit and loss statement, income statement, balance sheet summary, and more.

2 – Do Your Accounting From Anywhere – Most of us are constantly on the go which is why it feels like such a godsend when important software makes its services available on mobile apps. The QuickBooks app is available so you can do your accounting anytime and anywhere.

3 – Get Expert Guidance – Quickbooks provides free online resources like webinars and tutorial videos for those who have no accounting knowledge (I mean, who really understands accounting).

4 – Get the Perfect Accounting Services for Your Unique Situation – QuickBooks offers customizable settings and several add-on options allowing you to upgrade your service as your business grows. For example, you can add more users to your account as your business demands increase.

5 – Improve Your Organization – It’s awesome how many organization tools are available through apps like ClientHub, Expensify, and Productive. With over six hundred app integrations, you can combine all of QuickBooks’ benefits with your favorite software tools.

QuickBooks has three plans available for small business accounting. The Easy Start plan, which allows you to perform all of your basic accounting tasks costs $22 per month. QuickBooks’ most popular plan allows you to add up to three users to your account, track your time, manage different currencies, and manage your payments. It costs $44 per month. QuickBooks Plus allows you to add up to five users to your account, track project profitability, track inventory, and manage budgets. It costs $66 per month.

For an additional $20 (plus $4 per employee) each month, there’s the option of adding QuickBooks payroll to whichever plan you choose. QuickBooks Payroll allows you to pay employees through direct deposit with taxes automatically calculated – very convenient.

Need to make $20 quickly? Check out my guide on how to earn $20 per referral.

For a limited time, you can save 30% on a QuickBooks plan of your choice for up to 6 months! Click here to claim this exclusive Touchdown Money offer.

Bindu F, the CEO and founder of an advertising and marketing agency, gave a solid 9.9 out of 10 rating and a fantastic review:

“It’s something I recommend to every small business, especially if you don’t have money to spend on an accountant.”

If you’re looking to use QuickBooks and want to get ahead of the learning curve, you can check out this how-to playlist they’ve put together on their YouTube channel.

| Pros | Cons |

| Thorough financial reports | Learning curve if you have zero accounting knowledge |

| Scalable with plenty of upgrade options | Additional fees for payroll services ($20/month plus $4/employee/month) |

| Easy to share information with your accountant | |

| Easy to find an accountant | |

| Free online resources | |

| Convenient mobile app | |

| Hundreds of app integrations |

Get started with QuickBooks here!

2 – FreshBooks

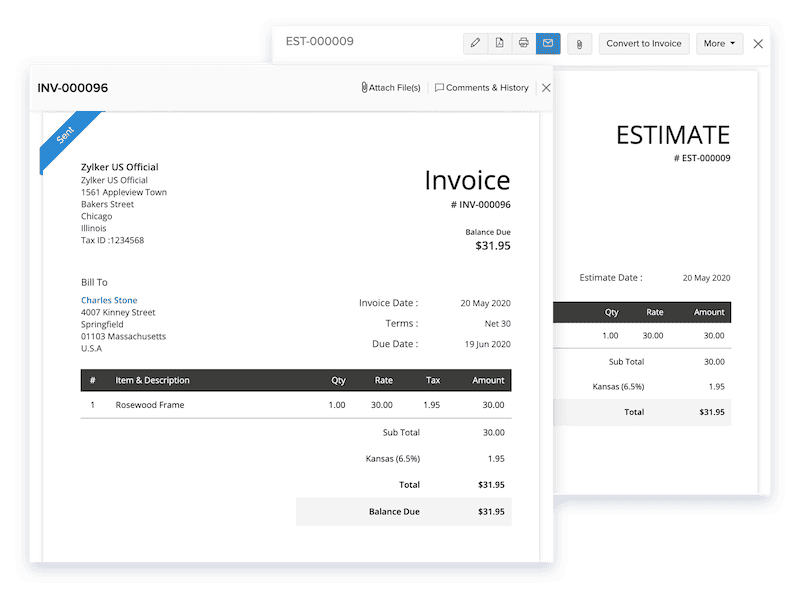

FreshBooks started as an invoicing software but eventually, they decided to grow with their customers and began offering a wide range of accounting services. Being a self-employed professional himself, the creator of FreshBooks, Mike McDerment is familiar with the needs of small business owners.

FreshBooks is considered one of the best accounting software programs for freelancers and small businesses alike. In addition to being functional, FreshBooks will give you an excellent bang for your buck as it will cost you only $15 a month. We consider it one of the best small business accounting software programs for value.

Top 5 Benefits Of FreshBooks

1 – Get the Help You Need Without Worry – FreshBooks provides both phone and email support. Many customers have raved about how prompt FreshBooks’ support is. This can be a lifesaver during an accounting emergency or when you simply have a question.

2 – Get Started Quickly – The easy interface has both a support page and video webinars available, the set-up process is a breeze. According to reviews, even customers with absolutely no accounting experience have found FreshBooks to be simple and pleasant to navigate.

3 – Impress Your Clients – Since FreshBooks started as an invoicing service, it’s no surprise that it shines in this department. You can wow your clients by creating attractive invoices, adding your logo, and customizing thank you emails.

4 – Get Paid For Your Time and Mileage – Freshbooks allows all of their customers to benefit from their excellent tracking tool. If you own a small business, you should be tracking your time. As FreshBooks says on their site, unbilled hours are unpaid hours.

5 – Win More Clients – Customizable proposals give you the perfect opportunity to showcase the unique value you bring to the table. A great proposal has the power to land you exciting new projects but they can be quite time-consuming to put together. Not only will you be able to impress potential clients but with a detailed proposal, you can ensure a confusion-free start to your next project.

FreshBooks is an excellent value for your money. The Lite plan is $15/month and is perfect for self-employed professionals with basic accounting needs. If you manage up to fifty billable clients, the Plus plan is for you. It’s just $25/month. Now if you want to allow your business unlimited room for growth, try the Premium plan. It costs $50 per month.

If you own a business with complex needs, the select plan is perfect for you. It offers access to a dedicated account manager, support for migrating financial information from other software, and many more specialized services. The price of the Select plan is customizable.

If these options are more than you’re looking to spend, be sure to check out FreshBooks’ homepage as they frequently have sales running.

Jake, a consultant who discovered FreshBooks from a client, said:

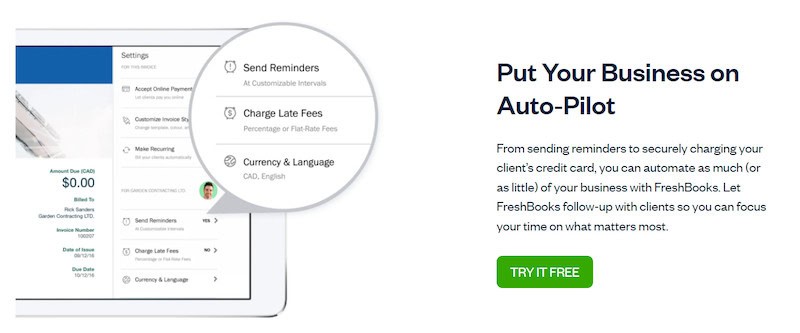

“Since I started using FreshBooks, every part of my business runs smoother. The invoicing feature makes me look and feel more professional, and I spend far less time juggling administrative work. With the flexibility FreshBooks offers through online payments, automated payment reminders, and detailed reporting, I’ve been able to dedicate more time to my clients and grow my business into everything I want it to be.”

If you like what you’ve read and want to get started with FreshBooks, check out this YouTube video on their channel that walks you through the process.

If you’re not sure you’re ready to take advantage of the awesome sale, sign up for a free trial here.

| Pros | Cons |

| Easy to use | No quarterly tax estimates like other accounting software |

| Professional Invoicing Tools | Limits on users and clients for cheaper plans |

| Time and Mileage tracking | |

| Affordable | |

| Excellent customer service | |

| Estimates feature allows you to win new clients |

3 – Wave Accounting

Whether you’re new to the world of business or simply want to dip your toes into cloud accounting, it's always great to have a free option. Wave Accounting is extremely easy to navigate, with no hidden charges, their mission is to empower small business owners to manage their finances fearlessly.

With over 4 million users in 200 countries, Wave is making strides to provide cloud-based double-entry accounting to small businesses everywhere. That’s why they provide everything a typical small business needs for an unlimited number of financial accounts and an unlimited number of users.

Top 5 Benefits Of Wave Accounting

1 – Save Money – Some small businesses spend thousands on financial services. Yes, accounting help is a worthy investment to support the success of your business but if you can get quality financial services for free, why wouldn’t you?

2 – Get Started In Seconds – Wave Accounting’s intuitive interface makes it easy to get started quickly without even having to enter your credit card information (unless you’re using their payroll service). Simply enter a few details about your business and you’re ready to go!

3 – Get Paid On-Time – Wave automatically syncs your invoicing with your accounting, allowing you to manage all of your financial affairs in one place.

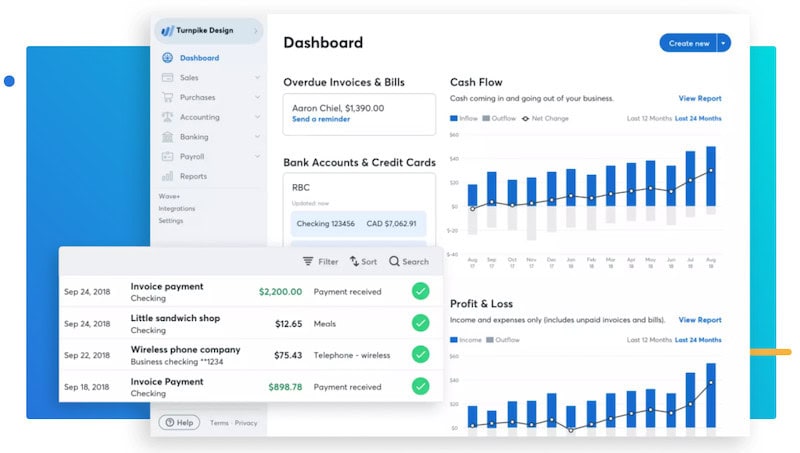

4 – Get Vital Information – Once you log into your account, the comprehensive dashboard will show you an easy-to-understand summary of all your business finances. Overdue invoices and bills, cash flow reports, and profit/loss reports are represented for you to keep you informed.

5 – Get The Support You Need From Experts – Even if you’re able to manage your accounting for free online, it’s wise to seek expert advice when questions and concerns come up. That’s why Wave Accounting makes it super simple to invite your accountant to access your account via email. Alternatively, you can book a call with Wave Advisors who are all trained bookkeeping, accounting, and tax professionals.

Wave Accounting is the best small business accounting software available for free. It’s particularly effective for free basic accounting and invoicing services. However, to accept payments and use Wave payroll, fees apply. Wave’s payment feature gets you paid quickly (as soon as one business day) and fees are as low as 1%.

Wave’s self-service payroll costs $20 a month (plus $6 per paid employee or independent contractor). Self-service payroll calculates how much you owe in federal taxes, but you have to file your information and pay on your own. Full-service payroll does all the work for you and costs $35 a month (plus $6 per employee or independent contractor).

Steel & Oak Designs, a unique carpentry business, uses Wave Accounting to manage its finances. Read what co-founder Jono had to say:

“The invoicing on Wave is quite handy because we’re able to create multiple versions of the types of products we sell. Everything we make is custom, so each one will be a variation of the other. It’s not rigid where this is one thing and this is another and you don’t have any flexibility. It’s nice to have a heading and a description section for each item, just because there’s a lot of detail that needs to be put into each of our invoices. So having that depth of information on it is quite handy. Obviously, the online payment element is great for credit card payments and rapid payment, too.”

You’ll be able to get started with Wave very quickly thanks to this video:

Looking to try cloud accounting? Not only is Wave Accounting functional, flexible, and simple but it’s also free! Get started here.

| Pros | Cons |

| Free | Not easily scalable |

| Easy to use | Limited support |

| Additional accounting help available with Wave Advisors | Payroll services not included in free plan |

| Affordable payment and payroll options | |

| Easy to invite your accountant via email |

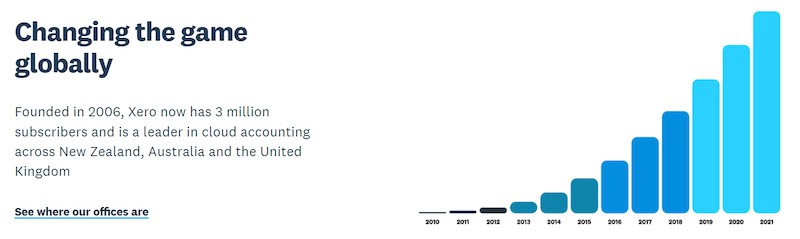

4 – Xero

Xero is a business accounting software that prioritizes connection. As a small business owner, you can manage your finances and improve your productivity at the same time thanks to Xero’s many features. It offers you basic accounting services like invoicing, accepting payments, analytics, and sales tax services.

Xero even connects to your bank. In addition, you can track orders and deliveries, manage inventory, and monitor the profitability of each project. These features help you stay organized and streamline your daily business operations. 3 million subscribers trust Xero’s services to help them manage their companies. Let’s explore why!

Top 5 Benefits Of Xero

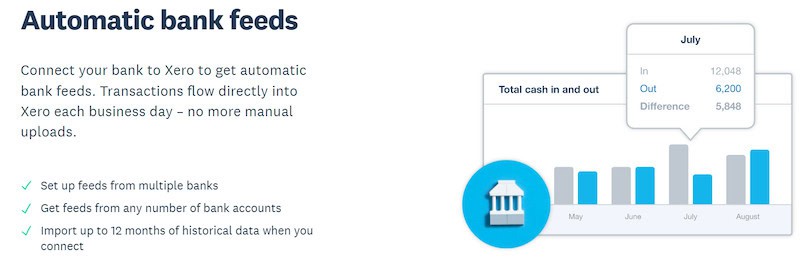

1 – Stay On Top Of Your Cash Flow Efficiently – When you connect your bank to Xero, your transactions are imported each business day. That means no manual uploads! With this feature, you get an up-to-date view of your business finances from multiple accounts if needed. Plus, when you’re just starting and want a view of how your business is fairing, you can import up to twelve months of historical data.

2 – Ditch Confusing Spreadsheets – Xero job tracking keeps you organized from the beginning of your projects to the end. First, create professional quotes, then track your billable hours before requesting payment and viewing the profitability of each job. The project tracking software breaks down all your expenses and your profit margins so you have a clear understanding of how each project performs financially.

3 – Know What’s In Stock – The inventory management feature allows you to track up to 4000 items. You can easily look up how much of each product you have in stock as well as the value of your current inventory. You can also see what items are selling the best which allows you to make informed decisions about your marketing and inventory needs.

4 – Manage Foreign Currencies – Dealing with foreign currencies can be a pain for business owners but with Xero, you can enjoy instant conversions, view rate exchange updates in the ever-changing global economy, and view comprehensive reports no matter what currency you’re managing.

5 – Stay Connected – As your business grows it becomes more and more challenging to keep up with each client or customer. That’s why Xero’s contact management tool allows you to access each customer’s purchase history including invoices, payments, notes, and emails. You can also connect your email and Office 365 accounts for more crucial client management information.

Xero is easily the best small business accounting software for businesses seeking to manage all their finances in one place. It’s also reasonably priced. The Early plan is great for small business owners who are just getting started. It costs $12 per month.

Xero is also job management software, offering powerful tools to streamline workflows and manage projects efficiently.

The most popular, Growing plan offers unlimited quoting and invoicing in addition to all the basic accounting features the Early plan offers. It costs $34 per month.

The Established plan is great for businesses that are – well, established. It offers everything that the other two plans do in addition to project tracking, multiple currency management, and expense claiming. It costs $65 per month.

All plans include basic inventory management, contact management, and sales tax services. You also have the option to add payroll through Gusto for an extra $39 a month.

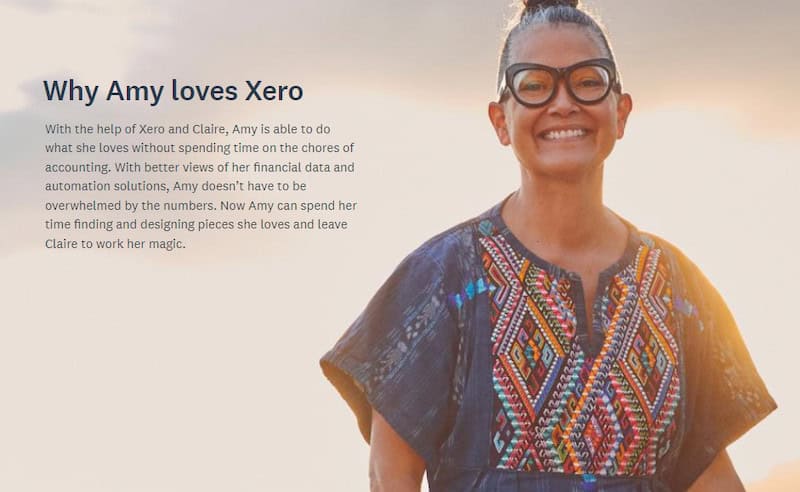

Sustainable fashion designer Amy Yeung enjoys Xero’s intuitive flow. She says:

“Xero just made it a seamless process. It's something that flows in and flows out through these beautiful tables and graphs and information that allow me to do what I love doing, which is creating.”

Learn how to set up your business with Xero with this helpful playlist:

Want to take advantage of all the amazing Xero perks we talked about? Start your free trial here!

| Pros | Cons |

| Inventory tracking | Limited billing and invoice services |

| Multi-currency accounting | No support available over the phone |

| Contact Management tools to stay connected | Payroll not included (available with Gusto) |

| Unlimited users | |

| Intuitive interface | |

| 24/7 online support |

Extra Point: Here's Why do you need an LLC to protect your small business. I created this LLC 101 guide and LLC checklist to help business owners like you get started. You can also choose the best LLC service in this Bizee vs ZenBusiness comparison. And read how to avoid using home address for LLC to protect your privacy.

5 – Zoho Books

Zoho Books is a business accounting software that manages ordinary accounting tasks such as invoicing and billing while automating workflows so that you can focus on more important aspects of running your business.

Your team is an integral part of your success which is why Zoho Books’ services are so focused on strengthening the relationships that matter. It facilitates collaboration between you and your vendors by allowing them to take control of their transactions. It also empowers your customers by offering them the opportunity to keep track of their purchases through a client portal.

According to reviews, users of Zoho books enjoy its ability to double as an accounting tool and a business dashboard thanks to its project feature. Zoho Books is one of the best small business accounting software available to those who want a platform that combines accounting with business administration. Let’s find out how you can use this awesome tool to manage your business.

Top 5 Benefits Of Zoho Books

1- Manage Your Team Easily – Effective collaboration is a wonderful asset to any business. Zoho’s project feature makes this easier by tracking your time, providing role-based access to your team members, and managing project expenses all in one place.

2- Save Time – With Zoho Books automation, you don’t have to worry about repetitive tasks like sending recurring invoices and chasing down payments. Also, by using bank rules, you can filter and categorize tasks so that you never miss anything.

3 – Manage Relationships With Ease – Thanks to the client portal and the vendor portal, you can maintain a transparent rapport with the people who matter most to your business.

4 – Be Stress-Free Come Tax Season – With Zoho Books’ Sales Tax feature, you can start preparing your taxes even before you make any sales. As you sell, you can conveniently keep your taxes up to date. By the time tax season rolls around, you can have Zoho calculate your tax liability in a consolidated report that’s ready to file.

5 – Do your Accounting From Anywhere – You can fit accounting into your busy life with Zoho Books’ functional app that allows you to gain insights quickly and easily, send invoices, make payments, and monitor your expenses right from your phone.

Zoho Books offers a free option for businesses that bring in less than $50k in revenue each year. You’ll be able to take advantage of all the accounting a new business needs. The free plan is limited, accommodating one account user and one accountant. Luckily, there are tons of other reasonably priced options to choose from.

The Standard plan is ideal for growing small businesses, allowing you to add three users to your account. It’s $15 per month when billed annually.

The Professional plan is for well-established businesses. It allows you to add five users to your account. It costs $40 per month when billed annually.

The Premium plan offers everything the Professional plan does in addition to a custom domain, budgeting, and room for ten additional users on your account. It costs $60 per month when billed annually.

Zoho Books is currently offering a FREE 14-day trial if you sign up using our exclusive Touchdown Money link, here.

Stephen J. Lalla is the CEO of Dynamic Image Marketing Systems and has enjoyed his experience with ZohoBooks. Here’s what he had to say:

“I've not seen anything as affordable and easy to use as Zoho Books. The reports are simple to run and can be scheduled to generate automatically. As a small business owner, I no longer worry about aging receivables with the automatic payment reminders in Zoho Books.”

If you’re convinced that it’s time to try Zoho Books, you’ll find this overview video useful:

To experience the Premium Zoho Books experience for free, start your 14–day free trial here.

| Pros | Cons |

| Fosters positive business relationships | Limited amount of invoices you can send with cheaper plans |

| 24-hour customer service on weekdays | Limits on team member access |

| Related services available like Zoho Invoice and Zoho Expense | |

| Easy to use | |

| Free option available |

Try out Zoho Books with a FREE 14-day trial, here!

Common Questions About Small Business Accounting Software

Is QuickBooks for Small Business Worth It?

QuickBooks is often considered the industry standard in Small Business Accounting Software. This makes sense due to its thoroughness, ease of use, and flexibility. The minor learning curve at the beginning is worth the effort. Besides, it’s always valuable to know as much as you can about your business’ finances.

What is the Easiest Bookkeeping Software to Use?

Wave Accounting’s mission is to make bookkeeping, accounting, and finances more accessible to small business owners. They’ve succeeded by providing free, easy-to-use accounting software for small business owners seeking to try cloud accounting. It only takes a few seconds to get set up and a support team is available.

Which Accounting System is Useful for Small Business?

QuickBooks is the best small business accounting software. It allows business owners to manage all of their finances in the same place and make informed decisions about their spending and other business decisions with their detailed analytics feature. Click here to save 30% off any 6-month QuickBooks plan.

How Do Small Businesses Keep Track of Expenses and Income?

Most small businesses use spreadsheets to track their expenses and income, but there are much better options. For example, Xero’s tracking tools make it much easier to gain a true understanding of your finances.

Small Business Accounting Software Free?

Wave Accounting strives to help business owners feel more comfortable with their finances. That’s why they offer an amazing free accounting software that introduces small business owners to accounting while being extremely functional

Best Accounting Software for Self-Employed?

Self-employed people, especially those who are new to the world of business, need detailed financial information, excellent tracking tools, and support. QuickBooks offers all of those benefits and more.

Best Small Business Accounting Software for MAC?

MAC users tend to prefer QuickBooks for their small business accounting. QuickBooks works seamlessly on all Apple devices with a functional, convenient mobile app available on the App Store.

Bookkeeping Software for Small Business?

QuickBooks is considered the best small business accounting software overall. Its intuitive dashboard makes it easy to stay organized and gain insights into your finances quickly.

Post-Game Report: Best Small Business Accounting Software Champions

- Intuit QuickBooks – Absolute Best Overall

- FreshBooks – Best Value

- Wave Accounting – Best Free Starter Option

Best of the Rest

Related: