We’re reader-supported. When you buy through links on our site, we may earn an affiliate commission.

I’ll provide all the inside information you need to settle the Betterment vs Acorns debate.

You already know investing is the secret to wealth. But meanwhile the average American saves only 3.2%1 of their income. Whoa.

Investing has changed my life. My only regret was not starting earlier! So let's get you started with micro-investing with either Betterment or Acorns.

But how are they different, and which is right for you?

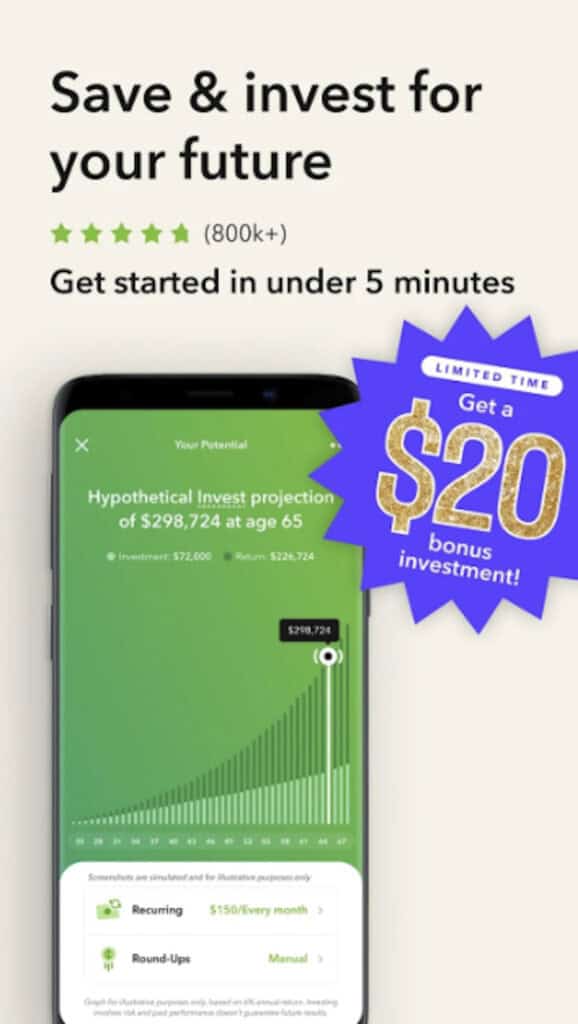

Spoiler alert: I prefer Acorns for easy investing because you only need $5 to get started. Plus for a limited time, you get a $20 welcome bonus investment when you join Acorns.

Table of Contents

Betterment vs Acorns Overview

Let’s start the Acorns vs Betterment conversation by looking at how each of these micro-investing platforms works.

Both Acorns and Betterment are apps that put investing on autopilot. Whether you choose Acorns or Betterment, you'll get set up with an investing portfolio to match your specific goals.

For instance, my investing goal is to live off a passive income that affords me a lifestyle of unlimited tacos on the beach while I laugh at strangers who can’t afford unlimited tacos on the beach, but then I say,

“Ah, just kidding, I’m rich with passive income! Come join me for unlimited tacos as I delight you with stories of compound interest and the formula A = P(1 + r/n)nt where A is the compound interest earned and P is your initial principal, and hey, where are you going?! I thought we were tacos amigos!”

A big difference when you’re considering Betterment vs Acorns is that Acorns makes it really easy to invest spare change. And Acorns is offering a $20 bonus for new users.

In my opinion, Betterment should step up their welcome offer to match Acorns.

Wonder if you should use Betterment or Acorns? Let me break them down one by one.

What Is Acorns and How Does Acorns Work?

Acorns is a user-friendly investing app that makes it easy for non-experts to grow their money.

Oh, and Acorns is promoted by Dwayne Johnson, AKA The Rock! Celebrity endorsements aren’t usually a good reason to use an investment platform – but c’mon, we’re talking about The Rock here!

Actually, The Rock is also an investor in the Acorns platform. So he believes in it. Check it out:

Acorns offers incredible features, including:

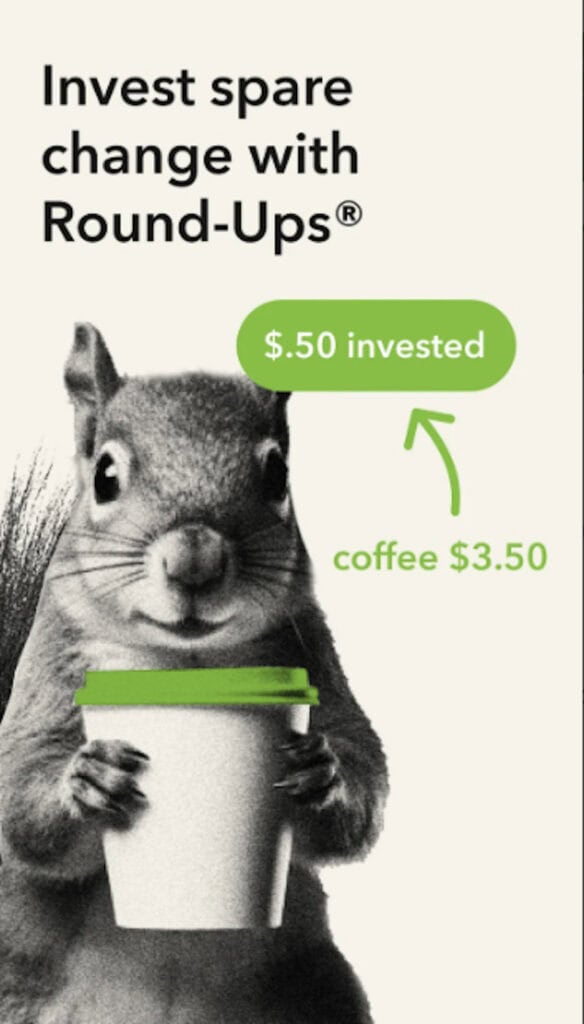

- “Round-Ups” – meaning the change from your everyday purchases will be invested automatically

- Recurring investments (so you can make saving and investing a habit)

- Investments in exchange-traded funds (ETFs) that include a mix of stocks and bonds

- Individual retirement accounts (IRAs)

- Investments in Bitcoin

- Custom portfolios that you can help build yourself

Look, if you’re super disciplined with your money and have an investment plan, you don't need Acorns.

Acorns is intended for people who want an easy solution that grows their money safely. I really like that:

- Acorns has a high-yield savings account HYSA option. (FDIC-insured up to $250,000)

- Acorns makes it easy to invest in diversified ETFs managed by trusted companies like Vanguard

- They even pay a good amount of interest to you on your checking account (most banks don’t)

What’s the catch with Acorns? It’s not free. It’s a modest cost but Acorns is worth it for beginners who want help auto-investing.

No investment is free. All have costs and risks. For beginners, Acorns is top-notch. If you know what you’re doing or are disciplined enough to DCA (Dollar Cost Average) into an ETF like VGT, no, you don’t need Acorns.

For everyone else, Acorns is a good deal.

Besides, if you decide to learn more about investing, you can always move your money out of Acorns later on.

To invest with Acorns, head to the official Acorns website and click “Get Started.” From there, you’ll give Acorns some basic information about your goals and expectations. Be prepared to share

- your age,

- time horizon (how long you want to stick with your investments),

- goals, and

- risk tolerance.

Acorns will then recommend an investment portfolio that matches your agenda.

In addition to investing help, Acorns also offers a checking account – which comes with the “Mighty Oak” debit card. Not only is that an awesome name, but the card itself is pretty cool. You’ll even earn interest (unlike most checking accounts).

You can download the Acorns mobile app (available for iOS and Android) and then check your investments from anywhere – even while waiting for tacos or on the toilet after you eat the tacos.

And the app is super popular, earning 4.6 stars on Google Play and 4.7 stars on the Apple App Store.

Looking for money you can use to start investing with Acorns? Check out this article on how to make 900 dollars fast.

What is Betterment and How Does Betterment Work?

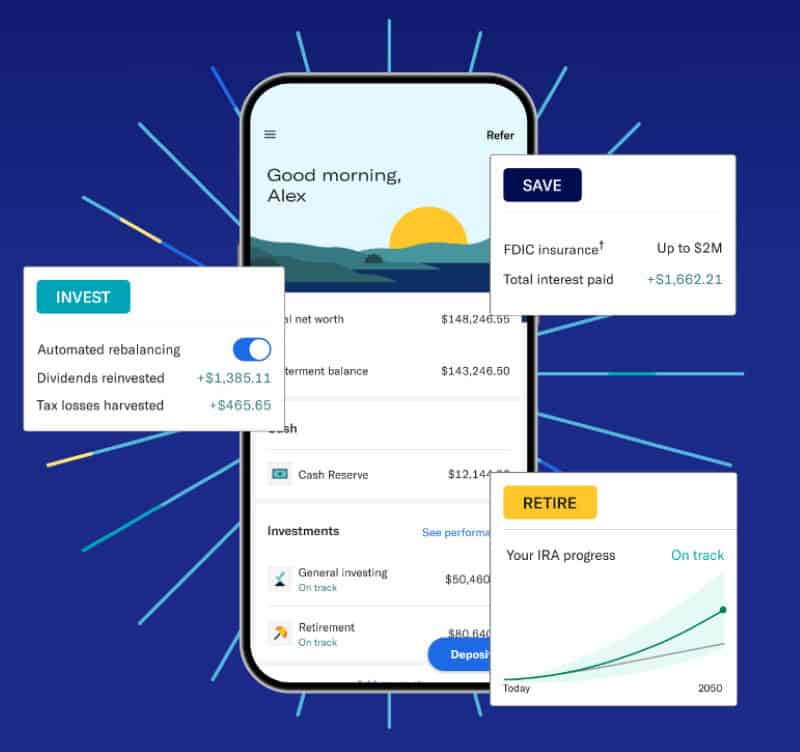

Betterment is an automated investing (or “robo-advisor”) platform. You deposit money into your Betterment account, and then they decide how to invest it.

That means you get the benefits of a smart investment strategy without having to spend hours of your own time deciding what to do with your money.

Betterment is a multifaceted (word of the day!) platform with sweet features like:

- A high-yield savings account (with a competitive annual percentage yield or APY)

- Individual retirement accounts (IRAs)

- A no-fee checking account

- Crypto investing

- Socially responsible investing (refuse to invest in corporations with CEOs who eat baby pandas)

- Special investment portfolios (with a focus on certain objectives)

You can track all these investments through your web browser or by downloading the Betterment app – which is available for iOS and Android.

Betterment might be on the cutting edge of robo-advising, but it’s not some hotshot startup. These people have been in business for over 14 years! During that time, they helped over 850,000 customers.

Interested in investing with Betterment? Here’s how it works:

- You sign up on the official Betterment website.

- You tell Betterment about your financial goals.

- Betterment creates an account based on your objectives.

- Betterment uses its technology to optimize your investments.

- You withdraw money as you choose.

So the plan is basically to capitalize on Betterment’s technology and expertise so you can invest smartly and grow your wealth. It’s no wonder Betterment is so popular. (Although not as popular as tacos al pastor. 5 out of 5, would eat again. And again. Bloated. Ugh.)

Betterment vs Acorns Cost

When choosing an investing platform, the goal is to make money, not spend it! And luckily, both sides in the Betterment vs Acorns debate are as affordable as fast food tacos, though not as gassy.

But each platform has a different pricing model – so let’s take a closer look at Acorns vs Betterment.

Betterment Cost

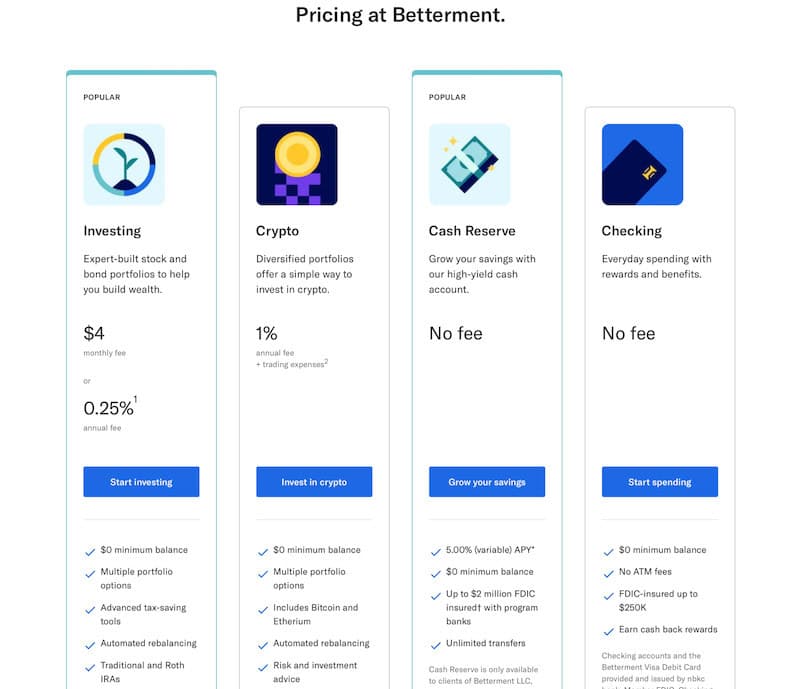

Betterment charges its customers on a feature-by-feature basis. That means the amount you pay in fees will depend on which features you’re using.

Let’s start with the standard investment feature, since that’s most relevant to the Betterment vs Acorns debate.

The base fee for an investment portfolio with Betterment is $4 per month. But if you set up monthly direct deposits of $250+, or if your total Betterment balance goes above $20,000, then you’ll pay an annual fee of 0.25% instead of the monthly fee.

To invest in crypto with Betterment, you’ll have to pay an annual fee of 1% – plus a trading fee of up to 0.15% per transaction.

And here’s some good news: The checking account and the high-yield savings account are completely free!

Betterment also gives you the option to upgrade to Premium. This is for bigger investors – the minimum investing balance is $100,000. But if you can swing it, you’ll get unlimited advice from a certified financial planner for an annual fee of just 0.65%.

Confused by all these variables? Don’t worry – Betterment has an awesome investment calculator on its website. If you enter how much you’re planning to invest, they’ll tell you how much you can expect to pay in fees.

Just as an example, if you deposit $8,000 and set up monthly direct deposits (of $250 or more), you’ll pay Betterment $1.67 per month.

(By the way, if having $8,000 to invest sounds crazy, check out this article: How to make 10k a month. You could supercharge your earnings with online gigs!)

Acorns Cost

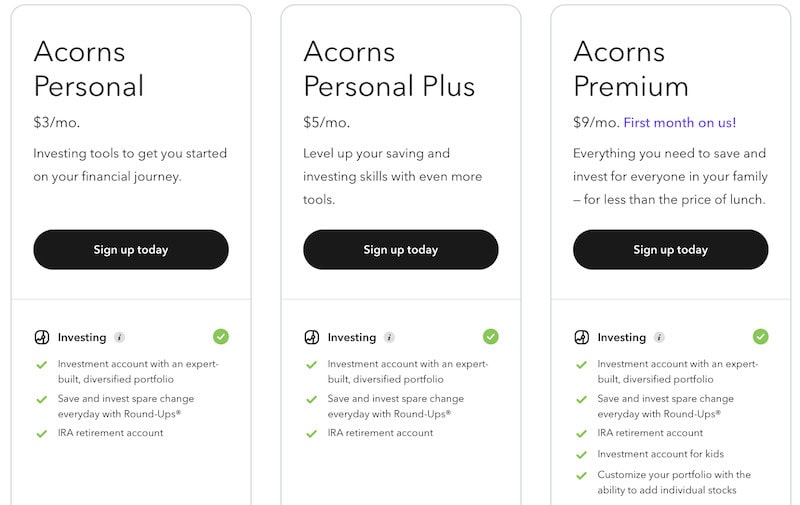

Acorns is a subscription service – meaning you’ll pay on a monthly basis. The monthly subscription fee ranges from $3 to $9.

Here’s a breakdown of the 3 Acorns subscription plans:

- Acorns Personal ($3/mo) – This covers the basics, including diversified investment portfolios and the “Round-Ups” automatic savings feature.

- Acorns Personal Plus ($5/mo) – This includes extra features like an emergency fund and live Q&As with experts.

- Acorns Premium ($9/mo) – You’ll get even more features, like the option to customize your portfolio and access to educational courses. Also, the first month is free!

Not sure which plan you need? The Acorns website has a tool that can help you decide. Just head to the pricing page of the official Acorns website and check off the features you want. Acorns will then highlight the plan that best meets your needs.

Pros and Cons of Betterment vs Acorns

One way to choose between Betterment and Acorns is by considering the pros and cons of each micro-investing platform. Well, what do you know – I’ve laid out those pros and cons below!

Pros and Cons of Betterment

Betterment Pros

- The cost is reasonable (especially if you set up direct deposits). The annual fee is just 0.25% if you get monthly direct deposits of $250+, or if your balance reaches $20,000.

- The company has been in business since 2010.

- The high-yield savings account pays a lot in interest.

Betterment Cons

- You need a balance of $100,000 to get a Premium plan. That means most new investors don’t have the option to pay for extra advice (which stinks, because beginners could use the help!)

- Crypto investments bring extra fees. To invest in crypto, you’ll need to pay an annual fee of 1% and a 0.15% “trading fee” for each transaction.

- There’s no “round-ups” or “spare change” feature. If you want to put your savings on autopilot, you’ll have to set up a recurring deposit.

Pros and Cons of Acorns

Acorns Pros

- The saving features can make investing part of your routine. With “Round-Ups,” the change from every purchase can go straight to your investment portfolio.

- You can build custom portfolios (with Acorns Premium). This is a great way to take advantage of professional expertise while also calling your own shots.

- The Acorns mobile app is super popular. Users on Google Play give it 4.6 stars, while users on the Apple App Store give it 4.7 stars.

- Acorns has been in business since 2012.

- Acorns’ high-yield savings account pays you a top interest rate.

Acorns Cons

- The plans are a bit more expensive. Acorns costs $3 – $9 per month, which makes it the more expensive option for some clients in the Betterment vs Acorns debate.

- You need to pay extra for the highest interest rates. The “Emergency Fund” has a high APY (amount of interest you’ll be paid), but it’s not included in the basic Acorns Personal plan.

- The basic plan (“Acorns Personal”) has limited educational resources. Want to talk with advisors and access courses? You’ll have to pay for one of the upper-tier plans.

Betterment vs Acorns Reviews

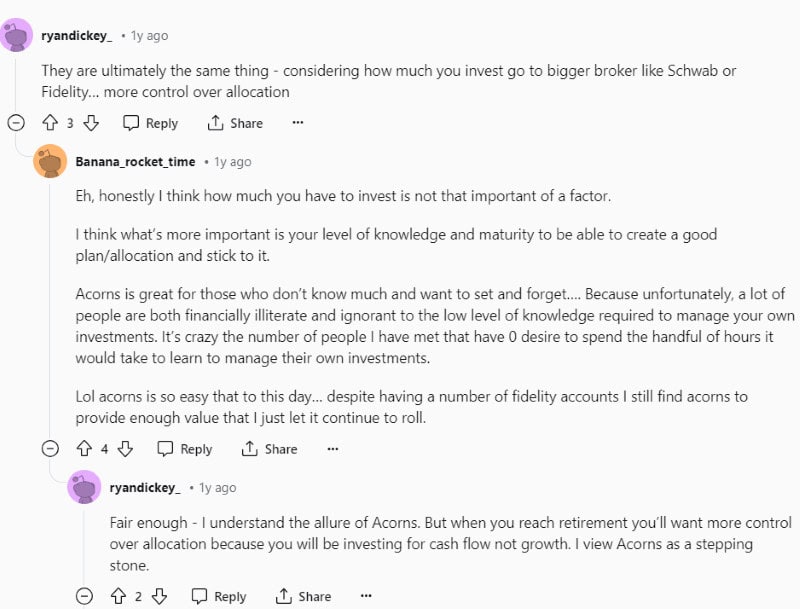

I found a Reddit thread where people were debating the “Acorns vs Betterment” question.

The original poster was asking about transferring funds from Acorns to Betterment. They said they were getting better returns with Betterment than with Acorns.

Someone responded with an interesting take on the Betterment vs Acorns question. They said both platforms are “ultimately the same thing.”

Another poster argued that Acorns is better for new investors who don’t have a lot of knowledge.

Betterment vs Acorns: Which is Better?

There’s a reason the Betterment vs Acorn debate is so tough: These platforms are super similar! They’re also both fantastic, offering investors a low-stress way to grow their wealth.

So, if Betterment vs Acorns were a wrestling match in chocolate pudding, I’d declare it a delicious tie. But if I had to pick Betterment or Acorns, gosh darn it heck, I’m going with Acorns because they have the $20 welcome bonus. I like money because I can use it for tacos.

But still, there are some slight differences between the platforms – meaning Acorns or Betterment might be better for someone in your specific situation.

Let’s say you’re:

- New to investing

- A habitual over-spender

- Struggling to save even a little bit of money

In that case, Acorns is probably best because of its “Round-Ups” feature. Every time you make a purchase, the “change” will go straight to your investments. It seems like a small thing, but it could help you start building wealth.

And what if you’re planning on investing a fair amount, and you want to spend as little as possible in fees? In that case, you should probably go with Betterment. If you set up monthly direct deposits of $250+, you’ll pay an annual fee of just 0.25%.

But really, the price difference in the Acorns vs Betterment comparison is minimal, especially because Acorns is offering a $20 welcome bonus for new users. Whichever platform you choose, you’ll get fantastic service at a great price.

So what if you don’t have any money to invest? Then check out this article on how to make more money. Or what can I sell to make money. Once you’ve got some savings set aside, you can invest them through Betterment or Acorns!

Commonly Asked Questions About Betterment vs Acorns

Alternatives to Betterment / Alternatives to Acorns?

Along with Betterment and Acorns, here are some other investment platforms to consider:

- Wealthfront

- Robinhood

- BlackRock

- Vanguard

- Fidelity

Passive investing with Acorns or alternatives is one of my favorite hobbies to make money because it’s not work, it’s easy and fun to watch your money grow.

Is Acorn Better Than Betterment?

In the Betterment vs Acorns debate, Acorns is better for new investors thanks to its “Round-Ups” feature. For every purchase you make with a linked card, the “change” will go directly toward your investments. It’s a great way to make saving money a habit.

Also, maybe I’m superficial, but the $20 welcome bonus with Acorns gives it the advantage in my book. (My book is a coloring book, but still.)

Is There Something Better Than Acorns?

Betterment is a “robo-advisor” that’s similar to Acorns – and some people might even consider it better. If you can set up direct deposits of $250 per month, Betterment will only charge an annual fee of 0.25% – so, depending on how much you invest, Betterment might be cheaper than Acorns.

But Acorns offers new users a $20 welcome bonus. So in my opinion, Acorns is the best micro-investing app.

Has Anyone Made Money on Acorns?

Lots of people have made money on Acorns. It’s a legit investing platform that offers portfolios created by experts. There’s never a guarantee that investments will make money – but the Acorns mobile app gets 4.7 stars on the Apple App Store, so plenty of real users say it works.

Plus you can make $20 with the Acorns welcome bonus for new users. So yes, you can make money with Acorns.

Acorns is a way to make passive income by investing steadily over time. It’s not really a way:

- How to make 50k a month

- How to make 30k a month

- How to make 20k a month

- How to make 20000 dollars a week

- Jobs that pay 1 million dollars a month

- Jobs that pay over 1 million a year

Acorns is a great way how to make money online for beginners through micro-investing.

Related:

- How to make 400 dollars fast

- How to make 600 dollars fast

- How to make 700 dollars fast

- How to make 800 dollars fast

- How to make 900 dollars fast

- How to make 3000 dollars fast

- How to make money fast

- LLC checklist

Sources: