We’re reader-supported. When you buy through links on our site, we may earn an affiliate commission.

I have two friends who each live comfortably on passive income from real estate investments. I’ll share how they do it.

First of all, if you earn at least $200,000 a year OR have a net worth of $1 million, I strongly encourage you to look closely at real estate crowdfunding with EquityMultiple. This method is especially popular with doctors, software engineers, and business leaders.

If that’s not you, check out Arrived instead. It’s a real estate investment platform backed by Jeff Bezos that allows ANYONE to invest in homes.

For everyone exploring how to invest 5k in real estate, I’ll talk about options like REITs, rent-to-own, and more.

Table of Contents

How to Invest 5K in Real Estate

In 2000, the median American home cost $165,300. Now, that value is approximately $420,000. The property is now worth 2.5 times as much as before.1

You might not have the money to buy an entire investment property on your own, but that doesn’t mean you’re excluded from the real estate game.

Here are proven ways how to invest 5k in real estate.

Real Estate Crowdfunding

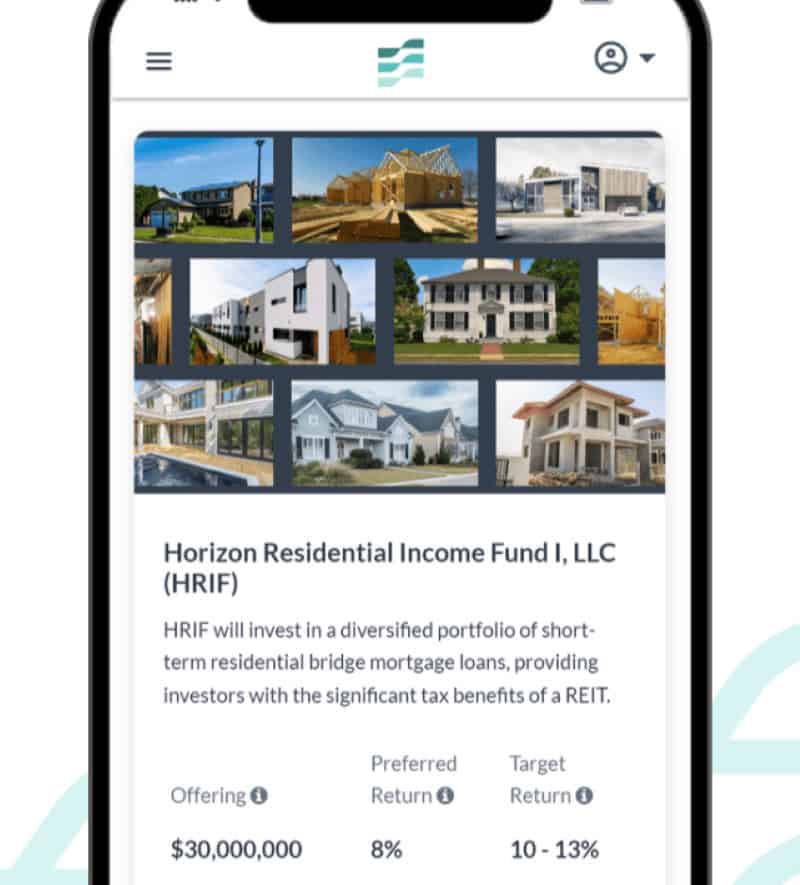

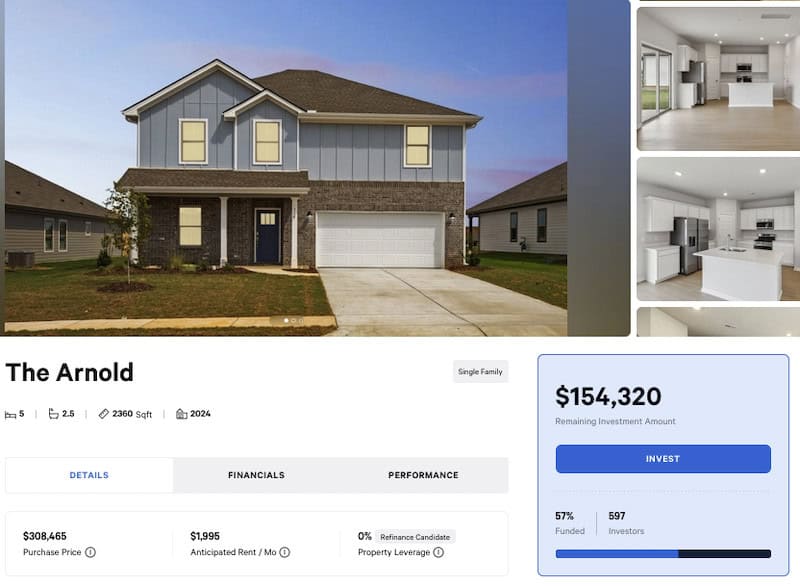

I’m going to talk about two main platforms. I’ll start with Arrived, which has no requirements for you to invest.

With Arrived, you pool your money with other investors into properties like single-family homes.

How do you earn money with Arrived? Two ways:

- Dividends – rent collected from your tenant by the Arrived team.

- Appreciation – this is the change in property value at the end of the investment hold period, which is between 5 and 7 years minimum.

OK, now the following is how to invest $5,000 dollars in real estate if you want to be a passive investor AND you earn at least 200k a year or have a net worth of at least 1 million.

Companies like EquityMultiple walk you through how to invest 5000 in real estate in only a few minutes.

I really like EquityMultiple because they carefully vet each property for you. Personally, I don’t want to be a landlord. You have to deal with tenants and with maintaining your property. Crowdfunding is more about wisely choosing a property.

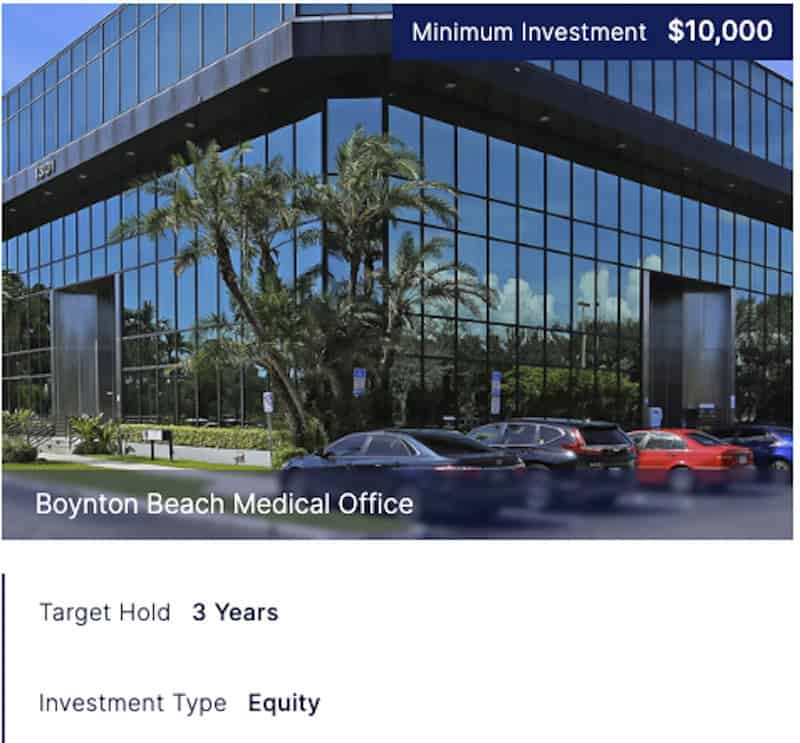

I also like that with EquityMultiple, you can invest in Commercial Real Estate (CRE). You can help grow a community with shopping centers, hotels, and warehouses that employ local people.

Rajagopalan is open about his strategy, “I use EquityMultiple for debt and preferred equity positions in office buildings, retail, car wash, condos, and hospitality.”

The basic idea behind real estate crowdfunding is simple. Companies list real estate investments, often individual properties, that they want to invest in. Then, individual investors choose to help fund the investment. Then, the company makes the investment. If it earns money, all the investors get a share of the profits.

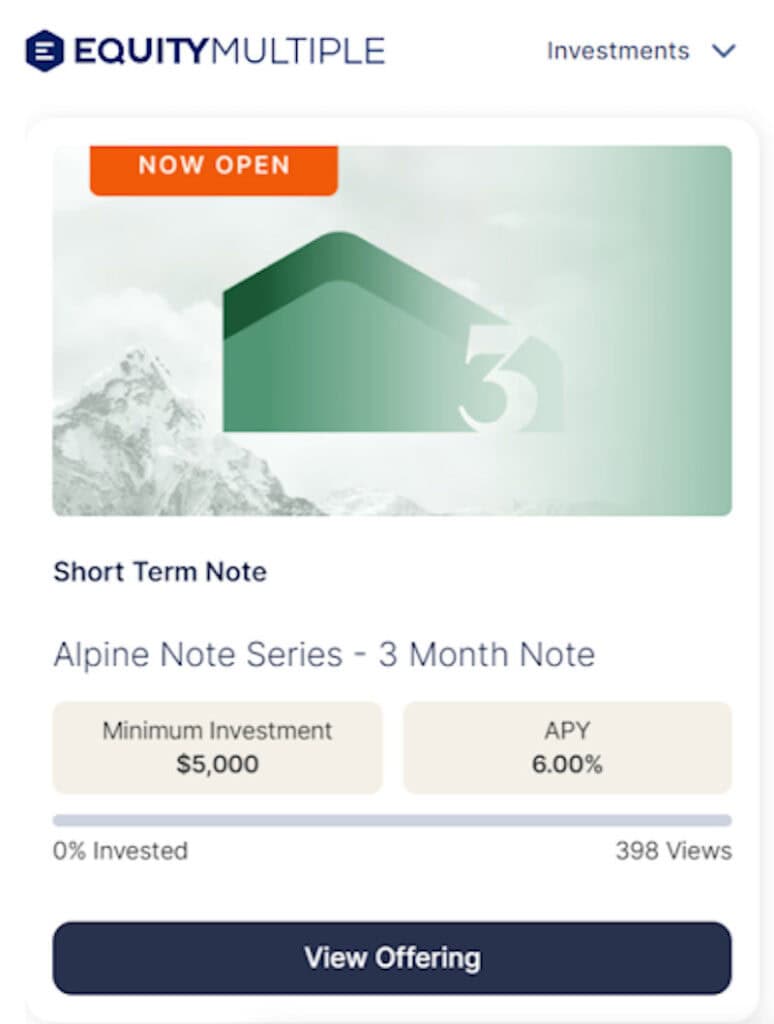

The downside of real estate investing is that you’re planting a tree. And yes, you’ll enjoy the fruit. But not today. If you want sweet fruit faster, EquityMultiple offers Alpine Notes. These are more liquid short-term investments, currently available in terms of either 3 months or 6 months.

You can learn more here.

How To Invest in Real Estate Crowdfunding

If you’re asking how to invest in real estate with 5k, then real estate crowdfunding provides an answer. This whole model is geared towards people who want to make smaller investments.

As a potential investor, your first step is to decide which real estate crowdfunding platform you want to use. If you qualify, I’d go with EquityMultiple. They do a great job of vetting properties, buying only 5% of the assets they consider. They also state that you can get started with as little as $5,000.

So, if you’re wondering how to invest 5k in real estate, EquityMultiple is a fantastic option.

Upright is another platform with a minimum investment of only $1,000. And it offers a twist on the traditional real estate crowdfunding platform. With Upright, you don’t invest in the actual property. You help fund a loan to an investor, which allows you to earn interest.

With both of these platforms, you’ll have to be an accredited investor. That means you have to meet money-related requirements (either a net worth of $1 million+ or an annual income of $200,000+) or get certain licenses.

Got accreditation? Picked a platform? From there, it’s easy! Sign up for the platform you’ve chosen, and start investing within the online portal. This is how to invest 5000 in real estate.

| Pros | Cons |

| You can invest as little as $1,000. | Certain platforms require you to be an “accredited investor.” |

| The investment is completely passive (with no management required on your part). | Some investments lack liquidity (meaning you lose access to your money). |

| You can invest simultaneously in a diverse set of properties. | You’re dependent on how well the platform chooses its investments. |

Extra Point: An even easier way to get started investing (that doesn’t require you to be an accredited investor or have $5,000) is to lend people money on the Lenme app. Check out my full Lenme review and my guide explaining How to flip money fast to learn more.

Real Estate Investment Trusts (REITs)

A real estate investment trust (REIT) lets you buy shares of a real estate investment project – just like you’d buy shares of a stock.

It’s also the most obvious answer to the question of how to invest 5k in real estate. With a REIT, you don’t need to buy a property yourself. You just need enough money to buy into the trust.

Here’s how it works:

- The REIT (which is a private company) invests in real estate projects that it expects to generate income.

- Investors buy shares of the REIT. In this sense, it’s like buying properties with a really big group of friends.

- When the investments make money, the investors receive their share of the profits in the form of dividends.

How to Invest in Real Estate Investment Trusts (REITs)

So, you’re wondering how to invest in real estate with 5k, and REITs seem like an appealing option. But what should you do next?

- Decide which type of REIT you want to invest in. Not all REITs are publicly traded on a stock exchange.

- Pick a specific REIT. Before you make your choice, look carefully at how different REITs have been performing.

- Open a brokerage account. You’ll need a brokerage account – which is easy to create with online brokers like Vanguard.

- Invest in the REIT. Once your brokerage account is open and funded, you can purchase shares of the REIT you’ve chosen.

| REIT Pros | REIT Cons |

| This is truly passive income since you have no involvement in managing the REIT. | You have no control over the decisions made by the REIT managers. |

| Some REITs (usually those that are publicly traded) have a lot of liquidity – meaning you can withdraw funds when you want. | There are often fees – including upfront costs that can run as high as 11%. |

| You can invest small amounts. | You’ll be taxed on the dividends you earn, even if you reinvest them. |

Rent To Own

Let’s say you want to know how to invest in real estate with 5k, but you don’t want a tiny slice of a property. You want a real house you can live in.

If that’s the case, then the rent-to-own model is perfect for you.

With rent to own, you start out renting a house with the plan to eventually buy it.

There are 2 types of rent-to-own contracts:

- Lease-Option. You’ll sign a lease. When that lease expires, you have the option to buy the home.

- Lease-Purchase. You’ll be legally obligated to buy the home when the lease expires.

Be careful with lease-purchase agreements. Yes, they’re an option if you’re wondering how to invest $5,000 dollars in real estate. But you’ll be in a tight spot if, when your lease is up, you’re forced to buy a house that you can’t afford.

How to Invest in Rent to Own Real Estate

Think rent-to-own is your answer to the question of how to invest 5000 in real estate? Then, here’s how to go about it:

- Look for rent-to-own homes in the desired real estate market.

- Agree on a purchase price with the property owner.

- Pay your rent each month – with a portion of the rent going towards the down payment for the home.

- Get a mortgage when your lease is up, and it’s time to buy the home.

| Rent to Own Pros | Rent to Own Cons |

| You get time to prepare your finances for home ownership (while settling into your long-term home!). | There are usually fees (including an “option fee,” which is usually 1% and 5% of the home’s purchase price). |

| You can lock in a favorable price for the home. | Your rent payments might be higher than what’s standard for your area. |

| You’ll build equity in your home before you even own it. | There’s no guarantee you’ll qualify for a mortgage when it comes time to buy the home. |

Wholesaling Real Estate

Wholesaling real estate allows you to act as a middleman, securing a contract for a property just to sell it to someone else. It’s basically a form of flipping, and it’s an option for how to invest in real estate with 5k.

Here’s how real estate wholesaling works:

- You (the wholesaler) enter into a contract with someone selling a property. You’ll have to leave a small deposit to make this work.

- You look for buyers. According to the contract you’ve signed with the seller, you’ll have to strike a deal for the house at a certain price and within a certain amount of time.

- When you’ve found an investor/buyer, you reassign the contract to them at a higher price – the price difference is what gives you a profit.

So with wholesaling, you’re not really buying a property as a long-term investment. You’re just linking a buyer to a seller. And you don’t need that much money to get started – making wholesaling a clear answer to the question of how to invest 5k in real estate.

How To Start Wholesaling Real Estate

Wholesaling real estate can be lucrative, but it takes strategizing. Pick the wrong property, and you could end up eating your initial deposit.

That’s why your first step as a real estate wholesaler is to find a property that works for this kind of deal.

Your best bet is a distressed property, meaning it has a lien or is being foreclosed. The owners of these properties are usually desperate to sell. And their desperation is your opportunity!

There are several places to find “distressed” properties:

- The Multiple Listings Service (or “MLS” – and not the one with Messi)

- Real estate auction sites

- Social media

- Foreclosure sites

Once you’ve identified a potential property, do your “due diligence” and try to decide what the property’s market value would be. The goal is to find a property that the seller would be willing to ditch for less than market value. That’s what would give you a profit.

So with real sale wholesaling, you do all the mental work of a hardcore real estate investor. You just get to “play the game” with less money.

| Pros | Cons |

| The main expense is the (relatively small) “earnest money deposit,” which makes this an option for how to invest 5k in real estate. | Requires a network of potential buyers in order to successfully close deals. |

| You choose the property yourself (meaning your real estate smarts will pay off). | The “profit margin” isn’t usually very high. |

| If you earn a profit, the money will come quickly. | You might need a real estate license (depending on the state). |

Become a Real Estate Agent

Becoming a real estate agent isn’t technically a real estate investment, but it is an investment in yourself. And it could help you launch a successful career in the real estate industry.

A real estate agent is someone who helps people buy or sell properties. No, you technically won’t be investing in real estate, but you’ll be right in the thick of the action – helping sellers and investors negotiate and close deals.

As a real agent, you get paid in the form of commissions. When a sale is completed, you’ll get a percentage of the sale price.

This can be a pretty lucrative profession. According to the U.S. Bureau of Labor Statistics, the average real estate agent earns $69,610 per year.2

How To Become a Real Estate Agent

Becoming a real estate agent is cheap and relatively easy. Follow these steps:

- Take a real estate prelicensing course (typically runs about $350). The length of the course depends on the state.

- Pass the state licensing exam. It usually costs around $100 – $300, and it’s all multiple-choice, so you don’t have to worry about answering open-response questions.

- Activate your real estate license. You’ll probably have to pay $200 – $400 in fees, but when you’re done, you’ll officially be a real estate agent!

This whole process costs around $1,000. I know you were wondering how to invest 5k in real estate, but this is an option that you can pursue with even less!

| Pros | Cons |

| You’ll have a flexible schedule. | You’ll have to work more hours (this is a job, not a passive investment). |

| The work is rewarding because you help people find their dream home. | There’s no guarantee of income since you’re dependent on commissions. |

| You’ll earn more as you gain knowledge and improve your sales skills. | It could take time to start earning decent money. |

Commonly Asked Questions About How To Invest 5K in Real Estate

Can I Invest $5000 in Real Estate?

You can invest $5,000 in real estate by buying shares of a real estate investment trust (REIT) or using a real estate crowdfunding platform. EquityMultiple is a reputable platform for people wondering how to invest $5,000 dollars in real estate.

How To Invest $5000 Dollars For Quick Return?

EquityMultiple is a legit way to invest passively in real estate. For a quick return, you’ll want to learn about their Alpine Notes here.

Another way to earn a quick return in real estate is to try real estate wholesaling. You’ll enter a contract with a seller, find a buyer, and then earn a profit when the sale goes through. The profits aren’t always great, but they come relatively quickly.

Can I Start Investing With 5K?

Yes, you can start with Acorns. They make it easy to passively invest in the stock market. Check out my comparison of Betterment vs Acorns.

Passive investing is one of my favorite hobbies to make money. Here’s how to make money online for beginners.

You can crowdfund buying single-family homes with Arrived for as little as $100.

Another option is to buy the most profitable online businesses on Motion Invest for 5k. Then improve it and flip it. (Learn how to buy an online business for sale.)

Finally, if you currently earn $200,000 a year or more, you can passively invest 5K in real estate with EquityMultiple.

How To Invest 5K in Real Estate With Little Money? / How To Start Investing in Real Estate With Little Money?

Here’s how to invest 5K in real estate:

- Sign up for a real estate crowdfunding platform like EquityMultiple.

- Buy shares in a real estate trust (REIT).

- Enter a rent-to-own agreement.

- Try real estate wholesaling.

Learn more with my low-cost business ideas with high profit.

Real estate investing is a legit way:

- How to turn 10k into 100k

- How to make 50k a month

- How to make 30k a month

- How to make 20k a month

- How to make 10k a month

- How to make 20000 dollars a week

- Jobs that pay 1 million dollars a month

- Jobs that pay over 1 million a year

How To Invest 5K in Real Estate in USA?

- Invest 5k with real estate crowdfunding platform EquityMultiple

- Buy shares in a real estate trust (REIT)

- Enter a rent-to-own agreement

- Try real estate wholesaling

Related:

- Business to start with 10k

- Online businesses for sale under $5,000

- Business ideas for women

- Best small business loans

- Best small business accounting software

- Best banks for small business

- Best business credit cards

- Financial planning for small businesses

- How to get a startup business loan with no money

- eCommerce credit card

- SEO for travel bloggers

- Therapy for business owners

- Solopreneur marketing

- Highest paying travel affiliate programs

- ShopMy vs LTK

- Substack vs Medium

- Kit vs Mailchimp

- Beehiiv vs Substack

- Kit review

- Best shipping label printer

- How to make money on X

- Why do you need an LLC

- LLC Checklist

- LLC 101

- How to avoid using home address for LLC

- Best LLC service

- Bizee vs ZenBusiness

- How to get sponsored by brands

- How to make 400 dollars fast

- How to make 600 dollars fast

- How to make 700 dollars fast

- How to make 800 dollars fast

- How to make 900 dollars fast

- How to make 3000 dollars fast

- How to make money fast

- How to double 10k quickly

- How to make more money

- Skool review

- Scribehow review

- LearnWorlds review

- Xperiencify review

- RankIQ review

- How to make money on Facebook

- How to make money on Pinterest

- Affiliate programs for moms

- Relationship affiliate programs

Sources:

1 – https://fred.stlouisfed.org/series/MSPUS

2 – https://www.bls.gov/oes/current/oes419022.htm

3 – https://equitymultiple.com/blog/investor-story-vinodh-rajagopalan