We’re reader-supported. When you buy through links on our site, we may earn an affiliate commission.

82% of Americans say money issues are stressing them out. 1

As a borrower, I’ll show you how Lenme is able to offer lower interest rates and fast payment, up to $5,000, with no paperwork.

As a lender, let’s talk about if P2P lending is a smart passive investment option for you.

In my Lenme review, I’ll reveal the pros and cons and share other Lenme app reviews so you can make up your mind for yourself.

Or, if you like to be hands-on, you can download the Lenme app now and follow along with my Lenme review.

Table of Contents

What Is Lenme?

Want to borrow money? You can do it with Lenme. Interested in offering someone a loan so you can earn interest? Lenme can do that, too.

Lenme is a peer-to-peer (P2P) lending platform.

And since Lenme is an online app, Lenme doesn’t have the same expensive overhead (like rent) as a traditional lending business with physical stores has. This allows Lenme to pass these savings on to borrowers with lower interest rates.

In other words, you can borrow money cheaply by downloading the Lenme app.

If you want to know how to make money fast, see my articles:

- How to flip money fast

- How to make 400 dollars fast

- How to make 600 dollars fast

- How to make 700 dollars fast

- How to make 800 dollars fast

- How to make 900 dollars fast

- How to make 3000 dollars fast

- How to make more money

Is Lenme Legit?

Lenme is a legitimate peer-to-peer lending platform. Lenme was founded in 2018 and is already a major player in the P2P industry.

Currently, Lenme has:

- 1,012,865 users

- 41,389 loans offered and received

- $18,100,000 lent / borrowed

And while Lenme app reviews are mixed (more on that below), plenty of people report having successfully borrowed or lent money through the app.

For borrowers with bad credit, you really have nothing to lose by trying Lenme. Credit cards and traditional lenders charge absurd interest rates. So why not see if anyone on the Lenme app is willing to lend you money?

You might have a good reason for a lender to take a chance on you when corporate banks won’t.

For my investors reading this, I’ll say some people do need a chance. They might have bad credit because of a medical emergency or simply because they’re new to credit and don’t have enough of a history to get a loan from a bank.

But this isn’t a charity, so as an investor, make smart decisions based on new information. Don’t give out money randomly, hoping for the best, and try to stay away from lending for emotional reasons, like the 90-year-old lady who needs $700 to get her parrot private Italian language lessons.

Is Lenme Worth It?

Here’s the conclusion of my Lenme review: The platform is worth it for both borrowers and lenders – if you’re careful about it.

The great thing about Lenme is that you can request a loan with any credit score.

Does that mean you’re guaranteed to get an actual loan? No, it depends on if any lenders decide to accept your request. But at least you can see if there are any takers!

And even if you have good credit, requesting a loan through Lenme is worth trying.

The lenders on the platform will be competing for your money. So, as a person with good credit, you’re a safer bet. Investors may choose your loan request to diversify their portfolio. Your loan will make them less returns, but it’s a safer return that balances their riskier bets that pay them more money.

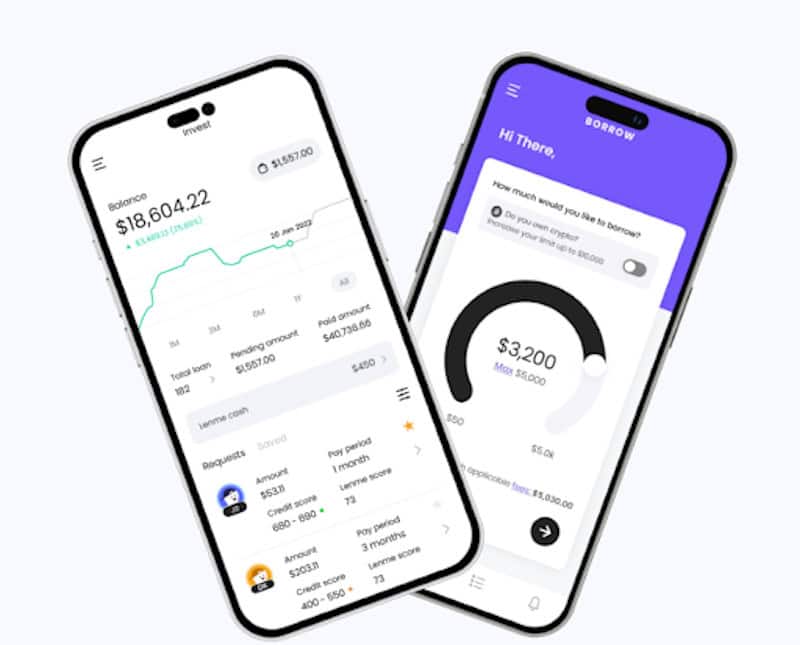

Lenme gives investors / lenders access to data to help make decisions. You can analyze this data yourself, or allow the Lenme algorithm to suggest loans to you based on your stated risk and reward tolerance.

If you’re using Lenme because you need money to start a business, check out my articles:

- Best small business loans

- Best business credit cards

- eCommerce credit card

- Financial planning for small businesses

- How to get a startup business loan with no money

How Does Lenme Work?

Lenme itself doesn’t lend anyone money. You can think of it as a matchmaker, saying, “Hello, Mr. Borrower. Hello, Miss Lender. Let me introduce you to each other.”

So Lenme can be used for two distinct purposes: to borrow money, and to make money by offering loans. In my Lenme review, I’ll tell you how to do both of them.

Let’s start with the question of how to borrow money on Lenme. Requesting a loan takes just a few minutes, and anyone can do it – no matter their credit score.

To request a Lenme loan, follow these steps:

- Download the Lenme app (available on Google Play and the Apple App Store).

- Verify your identity within the app.

- Connect your bank account.

- Request a loan, stating the amount and payback period.

Your request will then appear in the “Lenme Marketplace,” where lenders will see it alongside other loan requests. Different lenders can offer you a loan with a certain interest rate. It’s your decision whether you want to accept each offer or wait for another to come in.

See a rate you like? Then, accept the loan! The money will appear automatically in your bank account. And when repayment day comes, Lenme will automatically make the transfer. It’s all designed to be as convenient as possible.

And yes, Lenme does charge a fee (they’re not doing this out of the goodness of their hearts), but the amount is totally reasonable. The fee is $3 or 1% of the total loan amount (whichever is higher).

So, borrowing money on Lenme is a breeze – but what if your goal is to offer loans?

Here’s how to offer loans through Lenme:

- Download the Lenme App.

- Create and fund your Lemne account.

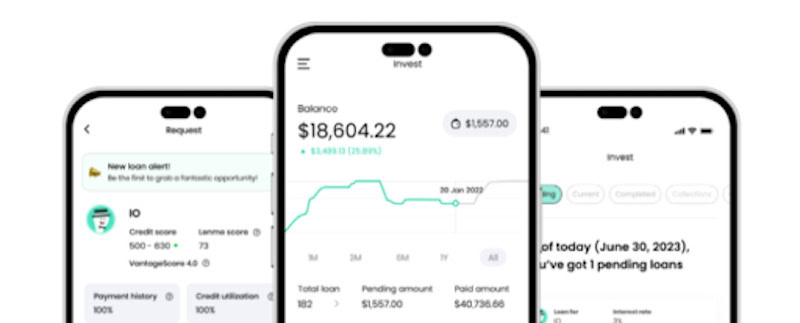

- Review the listings of loan requests (you’ll get access to over 2,000 data points, so you can make informed decisions).

- Offer loans to requestors of your choosing.

- Receive the loan payments automatically when the borrower pays you back.

The money from the loan repayment will go to your Lenme account, but you can withdraw it for free at any time.

As a lender, you’ll have access to the Lenme Dashboard, which gives you real-time data on earnings and expected payouts.

Not only is this important for practical purposes (you need to know when your money is coming back), but it's also pretty darn cool.

What Is The Catch With Lenme?

The closest thing to a catch with Lenme is that borrowers aren’t guaranteed to get a loan. You can request a loan regardless of your credit score, but that doesn’t mean a lender will actually offer to lend you money.

As a lender with Lenme, know that these are far from guaranteed investments like a savings account! Instead, you’re trying to make higher returns. So naturally, there’s the risk that some borrowers may make late payments. Diversify your Lenme portfolio with high-risk and low-risk P2P loans.

Is Lenme Safe?

Lenme is a safe platform you can use to borrow and lend money.

Lenme has earned 4.2 out of 5 stars in the App Store from over 31,000 people. The Google Play store also shows a similar score and good Lenme reviews.

All Lenme money transfers are powered by Dwolla, a payments platform that uses encryption and other high-tech solutions to protect users’ money.

Lenme Pros and Cons

To Lenme, or not to Lenme? That’s a question you shouldn’t answer without considering the pros and cons of the platform.

Lenme Pros:

- The user interface maximizes convenience. Sick of complicated application forms? Lenme brings Venmo-like simplicity to the lending space. They say you can lend or borrow money within 3 clicks.

- You can request a loan no matter your credit score. That makes Lenme a great option if your credit score disqualifies you from applying with traditional lenders.

- Loan repayments are transferred automatically. For borrowers, this takes the stress out of repaying a loan.

Lenme Cons:

- There’s no guarantee you’ll get a loan. Anyone can request a loan on Lenme, but it’s on lenders to decide whether or not they’ll actually lend you money.

- Some bank accounts don’t connect with Lenme. This is a common complaint I’ve seen in Lenme app reviews.

- It can be tough to get your account verified. In theory, you can request a loan in minutes. In practice, you might have to submit additional documentation – which can slow the process down.

As an investor, P2P lending is one of the fun hobbies to make money because you can do it in a couple of hours a week. Here’s more information about how to make money online for beginners from my personal experience.

Lenme Reviews

I’ve told you what I think about Lenme, but what are users saying online? Let’s look at Lenme app reviews to find out.

In a 5-star Lenme review, someone said they “absolutely love Lenme!” They praised both the “user-friendly” interface and the “responsive” customer service.

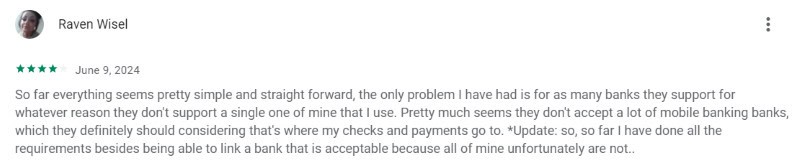

Another user left a 4-star Lenme review, saying, “So far everything seems pretty simple and straightforward.” But they did encounter a problem: None of their bank accounts could connect to the Lenme platform.

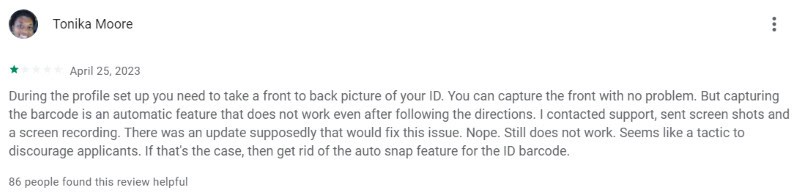

Someone else described a major issue in a 1-star Lenme review. They tried to sign up for the platform, but they never got past the verification process. Apparently, the app wouldn’t properly capture a picture of their ID.

If you’re considering loaning money with Lenme as a means of passive income, you might also be interested in my articles: how to turn 10k into 100k and how to double 10k quickly.

Common Questions About Lenme

Lenme Alternatives / Lenme Competitors / Alternatives To Lenme / Similar To Lenme?

Here are peer-to-peer (P2P) lending platforms that offer alternatives to Lenme:

- LendingClub

- Peerform

- Kiva

- Prosper

- Upstart

Is Lenme a Scam?

Lenme is a legit peer-to-peer (P2P) lending platform, and it definitely isn’t a scam. It’s been in business since 2018, and it has over a million users. Lenme is highly rated on the App Store and Google Play Store.

Does Lenme Affect Credit Score?

Requesting a loan from Lenme doesn’t affect your credit score. But when you agree to an actual loan, they’ll conduct a “hard check,” which could cause your score to temporarily dip slightly. This is totally normal.

And for now, repaying your loan won’t improve your score, but Lenme hopes to change that in the future.

How Long Does It Take To Get Money From Lenme? / How Long Does Lenme Take?

You get cash the same day with Lenme.

You can request a loan through Lenme in minutes – but there’s no way to know when you’ll be offered an actual loan. It depends on what lenders think of your offer. Once a loan has been agreed upon, you’ll receive the funds in 1 – 2 days.

How Much Does Lenme Cost?

Lenme charges a fee for each loan. The fee is 1% of the loan amount, and there’s a $3 minimum.

Related:

- How to make money on Facebook

- How to make money on Pinterest

- How to get sponsored by brands

- How to make money as a video editor

- How to make money as a travel photographer

- How to make money on Audible

- Xperiencify review

- Scribehow review

- Skool review

- RankIQ review

- SEO for travel bloggers

- Therapy for business owners

- Solopreneur marketing

- Highest paying travel affiliate programs

- ShopMy vs LTK

- Substack vs Medium

- Kit vs Mailchimp

- Beehiiv vs Substack

- Kit review

- Best shipping label printer

- How to make money on X

- Online businesses for sale under $5,000

- How to invest 5k in real estate

- How to make money as an independent artist

- How to make money as an attractive female

- How to make money as an attractive male

- How to make money on OnlyFans

- How to make money on OnlyFans as a couple

- How to make money on OnlyFans as a guy

- Relationship affiliate programs

- Affiliate programs for moms

- How to make 50k a month

- How to make 30k a month

- How to make 20k a month

- How to make 10k a month

- How to make 20000 dollars a week

- Jobs that pay 1 million dollars a month

- Jobs that pay over 1 million a year

- Low-cost business ideas with high profit

- Business to start with 10k

- Most profitable online businesses

- Business ideas for women

- Online business for sale

- LearnWorlds review

Sources: