We’re reader-supported. When you buy through links on our site, we may earn an affiliate commission.

Why do you need an LLC is the question. The answer is: running a business without an LLC is like eating soup with your hands.

Could you eat delicious soup by cupping your hands in the hot water and slurping it into your face? Yes. Should you? Only if you want to get burned.

An LLC prevents you from getting burned by

- lawsuits,

- bankruptcy, and

- taxes.

I’ve formed an LLC for each of my businesses. You can do it yourself or use ZenBusiness to do it for you.

Look, there’s a reason over 16 million Americans are self-employed1: Running your own business is awesome!

Now, I’ll explain all the details to help you answer the Do I Need an LLC question for yourself.

Table of Contents

Why Do You Need an LLC?

If you’re launching a new business, you might have heard that creating an LLC is a good idea. It might also sound like a lot of work (although it actually isn’t that much work, which I explain in this LLC 101 article).

You’re probably asking, Do I need an LLC?

Not to get all philosophical on you, but the answer to that question depends on your definition of the word “need.” Creating an LLC for your business might not be an absolute necessity, but it’s a smart idea.

Why do you need an LLC? Here are the key benefits:

- You’ll protect your personal assets from business-related risks. When you create an LLC, you’re setting your business apart from your personal finances. So, if your business gets sued or falls into debt, your personal assets (like a house or car) will remain untouched.

- You can easily keep your name and address private. When you invoice brands, form partnerships, or list your business on the internet, you can use the name of your LLC instead of your real name. This might be especially important when you know how to make money as an attractive female, how to make money as an attractive male, or when you know how to make money on OnlyFans, how to make money on OnlyFans as a couple, or how to make money on OnlyFans as a guy.

- You’ll give your business more structure. When you create an LLC, you’ll designate a business address, name a registered agent, and (usually) create an operating agreement. I won’t explain all that jargon here, but the point is that your business will have a solid foundation. It will also look a lot more legit.

- You’ll have more flexibility when you pay your taxes. With an LLC, you can choose to have your business taxed as a sole proprietorship or as a corporation. That means you can pick the option that allows you to spend less on taxes.

TL;DR: Why do you need an LLC? Because it’s the responsible thing to do as a business owner!

Do You Need an LLC To Start a Business?

I’ve already answered the question, “Why do you need an LLC?” But you still might be wondering, “Do I need an LLC?” As in, is it absolutely necessary?

Here’s my answer: No, you don’t need an LLC to start a business. (In most cases, it’s still a good idea! You don’t need to wear deodorant, but hitting the dance clubs with your “natural aroma” on display is a questionable decision.)

Let’s say you’re hesitant about the whole LLC thing. Maybe you’re allergic to paperwork, or maybe you’re dreading the filing fees (which can go as high as $500, depending on the state).

You can’t have a business with no legal structure. One way or another, when you file your tax returns, you’ll have to put your business into a category.

If you don’t create an LLC, here are the other forms your business could take:

- Sole proprietorship. This is what your business will be if you don’t create a legal structure for it. You’re the owner, and you won’t have any liability protection. So, if someone sues your business or your business goes bankrupt, your personal assets (house, car, cash, furniture, jewelry) would be at risk.

- General partnership. This is what you’ll have if you work with co-owners (partners) to run your business. If you don’t create a legal structure for the business, none of the partners will have liability protection (meaning that your personal assets would be in danger).

- Limited partnership. This business structure gives you two levels of partners: general partners with liability protection and limited partners with no such protections.

- Corporation. This is a more complicated structure. The company is owned by shareholders who elect a board of directors, and those directors run the company.

Think one of those other structures makes more sense for your business? Then, there’s a simple answer to the question, “Why do you need an LLC?” You don’t!

Don’t settle for a sole proprietorship because it’s the easy way out. Imagine losing your house to a business-related lawsuit just because creating an LLC seemed like “too much work.” Sometimes laziness comes back to bite you in the basement!

Should I Get an LLC Before Starting a Business?

Getting an LLC before starting a business isn’t 100% necessary, but it’s often a good idea.

Remember the answer to the question, “Why do you need an LLC?” It’s to protect your personal assets, give your business a structure, and save money on taxes. It makes sense to start taking advantage of those benefits as soon as possible.

Creating an LLC at the very beginning of your business’s lifecycle can also make things more convenient.

I mean, especially if you’re running one of the most profitable online businesses, don’t risk all your personal assets to a lawsuit.

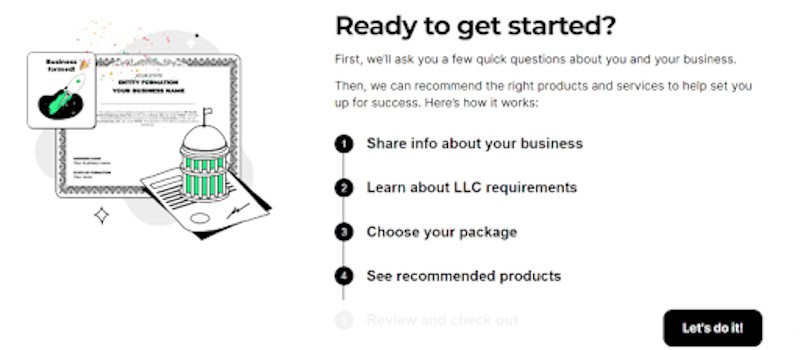

For many people, it makes sense to use a business formation service like Mark Cuban’s ZenBusiness (which is the best LLC service) when creating an LLC. And if you use a paid version of these services, you’ll get access to additional features like:

- An employer identification number (EIN)

- A domain name for your business’s website

- A business bank account

- Assistance with your articles of organization

- Templates for business contracts

- Help maintain compliance with government regulations

Instead of struggling to launch your business on your own (just to create an LLC later on), why not create the LLC right from the start and take advantage of these other services along the way?

At What Point Do I Need an LLC?

It’s usually best to create an LLC right when you start a business. That said, there’s usually no requirement to start an LLC at the beginning. So, if you’re asking, Do I need an LLC?, the answer is technically “no.”

But there might come a time in your business’s lifespan in which creating an LLC is even more urgent than ever. And when that time comes, you can file through ZenBusiness or do it yourself with my LLC Checklist.

Here are signs it’s time to create an LLC:

- You’re ready to save money on taxes. I’m not a tax professional so ask one to be sure. But typically, with an LLC, you are safe to take certain business deductions to reduce your tax burden.

- You’re selling products or services that could harm your customers. Let’s say you sell souvenirs, and you’ve just added pocket knives to your inventory. If a customer decides to juggle your souvenir pocket knives and stabs themselves in the eyeball and sues your business, you don’t want your personal assets exposed. So, why do you need an LLC? To protect your house, jewelry, vehicles, and other personal assets!

- You’re worried about the financial future of your business. Without an LLC, lenders can target your personal assets if your business falls into bankruptcy.

- You’re bringing co-owners and employees on board. The more people involved, the greater the risk of something going wrong. Getting sued and losing your house for something you did is bad enough. Imagine losing your house because your employee screwed up? Yeah, it would suck. So, file for that LLC to keep it from happening!

An LLC might also help you qualify for the

- Best small business loans

- Best banks for small business

- Best business credit cards (I’ve used an EIN with my LLC to qualify for credit cards to earn travel points and cashback)

What Do I Need To Start an LLC?

We’ve settled the main question: why do you need an LLC but there’s a pretty obvious follow-up concern: How do you start an LLC?

Luckily, it’s pretty darn simple. If it were rocket science, we wouldn’t see millions of successful LLCs across the country. And it’s even easier if you use ZenBusiness, an LLC service that offers a free basic plan.

Whether you use an LLC service or not, here’s what you need to start an LLC:

- A business name. You can’t register your business as “Placeholder, LLC.” Well, you could, but it would look pretty stupid. You need to choose a name that’s unique in your state and doesn’t infringe on any existing trademarks.

- A registered agent. This is the person who’s available during all business hours to receive legal documents on behalf of your LLC. You could do it yourself, but it’s way more convenient to have a service like ZenBusiness do it for you.

- Articles of organization. This is the fancy name for the forms you’ll send to your state’s Secretary of State to officially create your LLC. They’ll include some basic information about your business.

- An operating agreement. While this isn’t an absolute necessity for all LLCs, it’s a good idea. The operating agreement lets you lay out (in an official legal document) how your business will be managed.

- An employer identification number (EIN). This number isn’t technically necessary if your LLC won’t have to pay excise tax, but you may need it to hire employees and open a business bank account. You might as well get one from the start.

For more details on how to meet these requirements, check out my complete LLC checklist.

And here’s something you don’t need to start an LLC: Your home address. Read up on how to avoid using home address for LLC to protect your privacy.

Do I Need an EIN For an LLC With No Employees?

If you have an LLC with no employees, whether or not you need an employer identification number (EIN) depends on whether your business will have to pay excise tax.

Have to pay excise tax? Then, you need an EIN.

Don’t have to pay excise tax? Then, an EIN isn’t a legal necessity, but it’s probably still a good idea.

Businesses have to pay federal excise tax when they sell certain goods and services, including (but not limited to):

- Fuel

- Airline tickets

- Tractor-trailers

- Indoor tanning

- Tires

- Tobacco

So, if you’re offering any of those products, you’ll definitely need an EIN.

But even if you don’t have to pay excise tax, an EIN is still worth getting. Why? For one thing, you’ll likely need an EIN to create a business bank account. Separating your business finances from your personal finances is an absolute must.

Then, there’s the fact that you need an EIN to hire employees. Sure, you might be a one-person operation for now – but c’mon, let’s dream big here!

You might find yourself needing help sooner than you’d think, and you’ll want an EIN on hand so you can start hiring employees in a pinch.

By the way, you’ll grow your business faster if you read my Kartra vs ClickFunnels comparison – which breaks down two of the biggest online marketing platforms. This technology can help you attract customers!

Do I Need Business Insurance If I Have an LLC?

Business insurance is often a good idea (and might be a legal requirement) even if you have an LLC.

Now, I understand the question. You asked, “Do I need an LLC? and I said, “Yes, so you can protect yourself!” It’s normal that you’re thinking, “Well, if I’m protecting myself by creating an LLC, why do I need business insurance, too?”

Here’s the thing: Having an LLC protects your personal assets. Business insurance protects your business-related assets if things go wrong.

Imagine you have an LLC for your roadside fruit stand, but no business insurance. Then, there’s some major problem, like a customer chokes on an apple seed and sues you, or a midnight drag racer plows through the empty stand.

Thanks to the LLC, the lawsuit can’t target your house and other personal assets, but your business is totally screwed!

With business insurance, you could protect your business from that lawsuit or get money to rebuild after the accident.

Some business owners are legally required to have certain types of business insurance. For example, if you have employees, your state might require you to get workers’ compensation insurance.

But if there’s no legal requirement, then it’s up to you whether or not business insurance is worth it.

Common Questions About Why Do You Need an LLC?

Do You Need an LLC To Sell Online?

You don’t need an LLC to sell online. That said, having an LLC is a smart idea. You’ll give yourself an opportunity to save money on taxes and protect your personal assets like your vehicles, home, and jewelry from business-related risks like lawsuits and bankruptcy.

An LLC can help you remain anonymous if that's important to you.

Plus, that LLC will make your business name sound way more legit to customers.

Mark Cuban’s company ZenBusiness makes it easy to form an LLC. Or do the work yourself using my LLC checklist.

LLC For Online Business / Do I Need an LLC For an Online Business / Do I Need an LLC For an Online Store?

There’s no requirement to have an LLC for an online business, but you should still consider creating one. An LLC will protect your personal assets from business-related liabilities. It will also give your business a more formal structure (and a legit-sounding name!)

Services like ZenBusiness make it easy. Or do it yourself with my LLC checklist.

I’ve worked with multiple small business owners who primarily made money online with affiliate marketing. They all used an LLC for online business.

When you’re making millions of dollars – or plan to – it’s smart to set-up your business correctly.

At some point you might also put your online business for sale. Do you think a corporation will take you seriously if you haven’t even done the basics like form an LLC?

If you’re just starting out with your online store or online income, here’s how to make money online for beginners.

What Is the Point of LLC / Why Is LLC Necessary?

Lots of people ask, Why do you need an LLC? The answer is that an LLC creates a separate legal entity for your business, which protects your personal assets like vehicles and property from business-related liabilities like lawsuits and bankruptcy.

Even if your business is simply one of my hobbies to make money, there are tax advantages and financial safety reasons to form an LLC.

All of the following business models and more would benefit from an LLC:

- How to make money on Facebook

- How to make money on Pinterest

- How to make money as a video editor

- Reselling items because you know What Flips

- How to make money as a travel photographer

- How to make money on Audible

- How to make money as an independent artist

Don’t lose money on taxes and don’t put your personal property at risk in case your business gets sued by an angry customer.

You can form an LLC yourself or with the help of ZenBusiness.

Do I Need an LLC or Sole Proprietorship?

Most entrepreneurs can stick with a basic sole proprietorship if they want to, but creating an LLC is the more responsible option. That’s because having an LLC protects your personal assets from business-related liabilities, and you can still file your taxes as a sole proprietorship.

Even if you’re running one of my low-cost business ideas with high profit, an LLC is a must to protect you from lawsuits and potentially save money on taxes.

Why Would Someone Choose LLC?

Creating an LLC protects your personal assets, like your vehicles and property, from lawsuits, bankruptcy, and other business-related liabilities. In other words, if someone sues your LLC, they can’t come after your car, house, or jewelry.

LLCs also give you the flexibility to be taxed as a sole proprietorship or a corporation (you decide).

Related:

- Business to start with 10k

- How to turn 10k into 100k

- Business ideas for women

- Referral bonus apps

- Earn 20 dollars per referral

- Best small business accounting software

- Financial planning for small businesses

- How to get a startup business loan with no money

- Best small business firewall review

- Remote employee training

- Employee training software

Sources:

1 – https://advocacy.sba.gov/wp-content/uploads/2024/05/Economic-Bulletin-Second-Qtr-2024.pdf